👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just one session, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

When? 📆 December 17th at 7pm to 9pm (Central US)

What if I told you that a $1.5M portfolio could generate $120K a year in income… pay less than $10K in taxes… and never require you to sell a single asset?

In this video, I break down the exact Evergreen Portfolio model I personally use to generate over $200,000 per year in portfolio cash flow—without withdrawals, without relying on the stock market, and without slowly draining my net worth over time.

Most high earners and tech professionals are stuck in the traditional “grow and drawdown” retirement model. Your financial advisor builds a big nest egg… then you spend the next 30 years selling pieces of it just to live. It exposes you to sequence-of-returns risk, high taxes, and the real possibility of running out of money.

That’s not how ultra-wealthy families manage their wealth.

In this 16-minute breakdown, I’ll show you how to build what I call an Evergreen Portfolio—a wealth system designed to generate monthly income while your principal continues to grow. You’ll learn the same asset allocation principles used by TIGER 21 members and $20M+ family offices, adapted for individuals with $1M to $30M in assets.

Here’s what we’ll cover:

The failure points of the traditional 4% withdrawal model

How sequence-of-returns risk quietly destroys retirements

Why portfolios built only on stocks, index funds, and bonds underperform

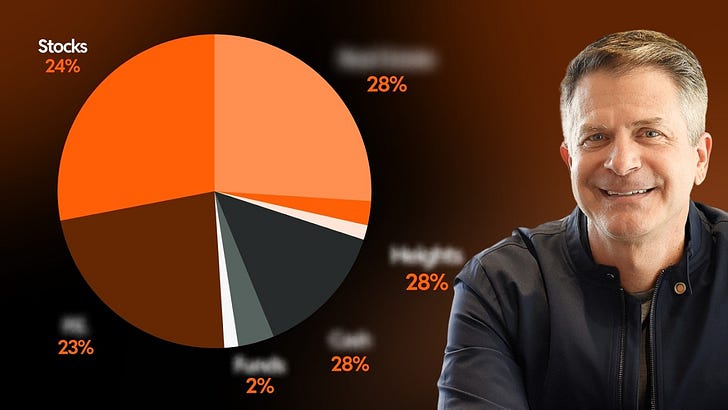

The three Evergreen asset categories: Income, Growth, and Capital Preservation

How to target 6%–12% annual yields with the right income assets

How tax optimization can add 2%–3% in returns every year

The four pillars of an Evergreen portfolio: selection, tax planning, risk management, and operational cadence

A real allocation example of a $1.5M Evergreen Portfolio producing $143,000 in annual income

How to start transitioning your own portfolio in a tax-efficient way

The mindset shift from being a portfolio “consumer” to becoming the CEO of your wealth

If you’ve built a seven- or eight-figure net worth but your portfolio isn’t giving you the freedom you want, this video will completely change how you think about investing, cash flow, and long-term wealth.

This is the exact framework I use. It’s how I built my own Evergreen Portfolio. And it’s how sophisticated investors protect and grow their wealth for generations.

If you want to stop relying on hope, stop selling assets, and start running your portfolio like an operating business, this video is your roadmap.

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows

👉 In just one session, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company.

If you like the podcast, support us by letting us know what you think (one click); please do that now!

Loading...

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Start up-leveling your knowledge - 🎧️ Follow our Podcast

Get our detailed How To Videos- 📺️ Subscribe to our Channel

Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps Way

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.