Are You Running a Portfolio or a Business? (The Self-Assessment)

Score yourself on the 7 MiFO Components and identify exactly where to start

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

📊 The 7 components every wealth business needs—and how to score yourself on each one

🎯 Where your biggest gaps are (and what they’re costing you)

🗺️ Your exact next step based on your score—from Reactive to Optimized

Hey Portfolio CEOs,

In 2016, I sat in a glass office on a Friday night while my kids were home without me.

I had $6M in assets. Multiple brokerage accounts. Real estate. Some private investments. A CPA who filed my taxes once a year.

On paper, I was winning.

In reality? I had investments without infrastructure. A portfolio without a plan. Assets without architecture.

I was spending Friday nights managing chaos—not running a business.

That’s when I asked myself the question that changed everything:

Am I running a portfolio, or am I running a business?

Today, I want you to answer that same question. Not theoretically. With a score.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m walking you through the four critical phases of building your own Micro Family Office in 2026.

Architect: How to define your legacy, investment thesis, and assess your financial foundation

Build: Setting up the legal structures, assembling a team of experts, and creating wealth systems

Run: Managing your portfolio with a clear rhythm and ongoing efficiency

Succession: Planning for the future—ensuring your wealth and knowledge pass on to the next generation

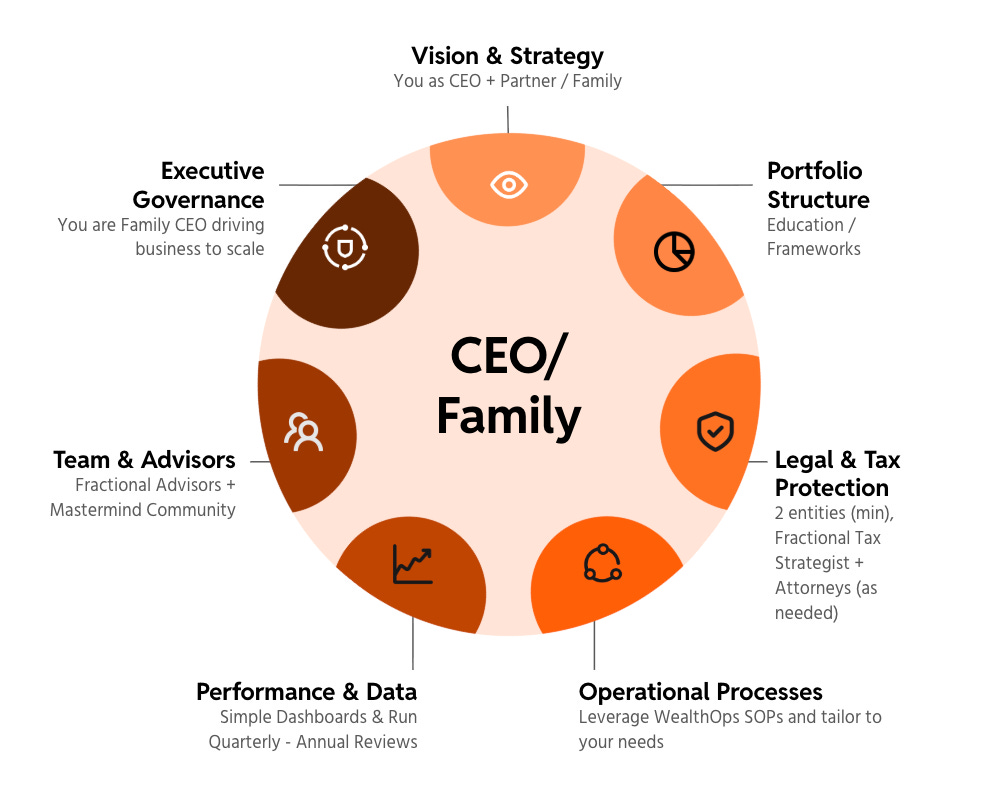

The 7-Component Self-Assessment

Every Micro Family Office—whether it manages $3M or $300M—runs on seven components.

Think of them as departments in your wealth business:

Vision & Strategy — Your wealth purpose and investment thesis

Portfolio Structure — How your wealth is organized and allocated

Legal & Tax Protection — Entities and tax strategy

Operations Process — Systems that create consistency

Performance & Data — Tracking what actually matters

Team & Advisors — Your coordinated expert partners

Executive Governance — Decision-making frameworks

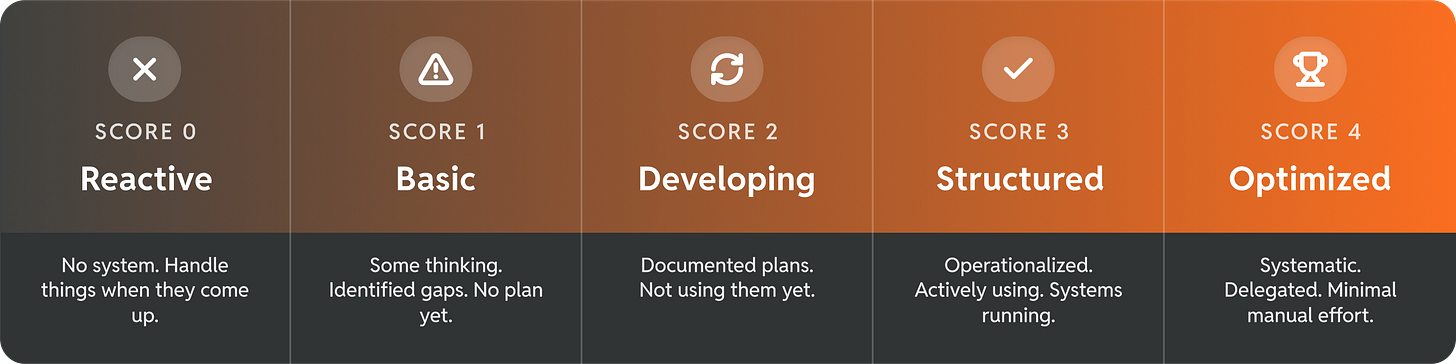

Here’s the assessment: Score yourself 0-4 on each component using the scale below.

Be honest. Most people overestimate where they are.

The Scoring Scale (0-4)

The brutal truth:

0 = Nothing

1 = Awareness (but no action)

2 = Documents (but not running)

3 = Running the system

4 = Running on autopilot

Now let’s score each component.

Component 1: Vision & Strategy

What it is: Your legacy statement (why this wealth exists) and investment thesis (how you’ll deploy capital).

My journey:

2012-2015: Score 0 — No legacy statement. Investing reactively.

2016: Score 1 — Wrote my first 14-word legacy statement: “I want financial independence so I can spend more time with my family.”

2017: Score 2 — Created full Investment Thesis document.

2018: Score 3 — Shared with my wife. Used it to make allocation decisions.

2020: Score 4 — Annual review on calendar. Family knows it by heart.

Score yourself:

0: Haven’t thought about why your wealth exists

1: You’ve thought about it, but haven’t written anything

2: You have a legacy statement written down

3: You’ve shared it with family and use it to guide decisions

4: It’s reviewed annually and drives every major decision

What I see most often: People skip this altogether. They jump straight to “what should I invest in?” without ever asking why. This is the most important component—and the most neglected. Without vision, every decision is a negotiation instead of obvious.

Your score: ___

Component 2: Portfolio Structure

What it is: Income architecture, asset allocation, how your wealth is organized to generate cash flow.

My journey:

2012: Score 0 — 90% single stock concentration after IPO. No income strategy.

2014: Score 1 — Realized I needed diversification and income. No plan yet.

2016: Score 2 — Designed Income Pyramid framework (Cash Flow, Structured Alpha, Asymmetric Upside).

2017: Score 3 — First full year executing the strategy. Portfolio generating $150K+ income.

2019: Score 4 — $200K+ annual portfolio income. Systematic rebalancing. Work optional.

Score yourself:

0: Assets scattered across accounts. No income strategy.

1: You know you should have a plan. Haven’t built one yet.

2: You’ve designed your allocation framework on paper.

3: You’re executing it. Portfolio income is growing.

4: Income covers lifestyle. System runs with minimal attention.

What I see most often: This component is often overlooked entirely. People focus on returns, not structure. But portfolio structure is what allows your wealth to align with your vision and unlock the goals you actually want. Without it, you’re optimizing the wrong metric.

Your score: ___

Component 3: Legal & Tax Protection

What it is: Holding Company, Management Company, trusts, tax optimization strategies.

My journey:

2012-2015: Score 0 — Personal brokerage accounts. No entities. Standard tax filing.

2016: Score 1 — Realized I needed liability protection and tax strategy.

2017: Score 2 — Formed Holding Company LLC. Estate planning documents drafted.

2018: Score 3 — Holding Company operating. Moved real estate holdings into it.

2020: Score 4 — Full Two-Company Architecture (Holding + Management). CTP relationship. Deduction Stack executing.

Score yourself:

0: Everything in personal name. No entities.

1: You know you need protection. Haven’t set anything up.

2: Entities formed but not really using them.

3: Entities operating. Assets moved. Tax plays executing.

4: Full structure operational. CTP managing strategy.

What I see most often: People are walking around with their shoes untied. Serious liability exposure. No tax strategy beyond what their CPA files. They don’t understand the games, strategies, and plays available to truly lower taxes—they just take what they’re given and don’t study it. This component has the highest cost of ignorance.

Your score: ___

Component 4: Operations Process

What it is: Bookkeeping, document management, compliance calendar, recurring processes.

My journey:

2012-2015: Score 0 — No bookkeeping. Found documents when I needed them. No calendar.

2016: Score 1 — Realized I needed systems.

2017: Score 2 — Hired bookkeeper. Set up document folders. Processes documented.

2018: Score 3 — Books reconciled monthly. Quarterly reviews with CPA on calendar.

2021: Score 4 — Bookkeeper runs independently. I review dashboards.

Score yourself:

0: No bookkeeping. No document system. Handle things as they come up.

1: You know you need processes. Nothing set up yet.

2: Processes documented. Not consistently following them.

3: Running on regular cadence. Books reconciled monthly.

4: Delegated. You review results, don’t do the work.

What I see most often: People don’t treat their wealth as a business, so operations score low. They handle financial tasks when they remember. No bookkeeping. No systems. This is what creates the Friday-night chaos I lived in 2016—constantly reacting, never running it systematically.

Your score: ___

Component 5: Performance & Data

What it is: Tracking net worth, portfolio income, returns against benchmarks, KPIs.

My journey:

2012-2015: Score 0 — Checked brokerage accounts randomly. No tracking.

2016: Score 1 — Started tracking net worth manually once a quarter.

2017: Score 2 — Built first dashboard. Tracked portfolio income monthly.

2018: Score 3 — Regular tracking. Quarterly reviews. Knew my numbers cold.

2022: Score 4 — Automated dashboard. Pulls data from all accounts. Review takes 15 minutes.

Score yourself:

0: Don’t track regularly. Check accounts when you remember.

1: You know your approximate net worth. No regular tracking.

2: Built a dashboard or spreadsheet. Don’t update it consistently.

3: Track monthly or quarterly. Know your numbers.

4: Automated. Dashboard updates itself.

What I see most often: Same as Operations—wealth isn’t treated as a business. People check brokerage accounts randomly but don’t track what actually matters: portfolio income, expense coverage, progress toward work-optional. If you don’t measure it, you can’t manage it.

Your score: ___

Component 6: Team & Advisors

What it is: CPA, CTP, bookkeeper, estate attorney—assembled, coordinated, working together.

My journey:

2012-2015: Score 0 — One CPA. Filed taxes once a year. No other advisors.

2016: Score 1 — Realized I needed a team, not just one person.

2017: Score 2 — Hired bookkeeper. Engaged estate attorney. Advisor list documented.

2018: Score 3 — Full team: Bookkeeper, CPA, CTP, estate lawyer. Quarterly rhythm.

2021: Score 4 — Team coordinates without me driving. They talk to each other.

Score yourself:

0: One CPA who files taxes. That’s it.

1: You know you need more specialists. Haven’t hired them.

2: Team identified and hired. Don’t meet regularly.

3: Regular meetings. Proactive tax planning. Team executing.

4: Team coordinates independently. You’re the CEO, not the operator.

What I see most often: People don’t understand what it takes to have a real team and the right advisors. They settle for average or below-average—I’ve talked to hundreds of people deeply unsatisfied with their tax advisor who won’t do anything about it. They don’t know better exists, so they accept mediocre.

Your score: ___

Component 7: Executive Governance

What it is: Decision-making frameworks, family alignment, succession planning.

My journey:

2012-2015: Score 0 — Made financial decisions alone. No framework. Ad hoc.

2016: Score 1 — Wrote legacy statement. Started thinking about decision frameworks.

2017: Score 2 — Created 30-Second Investment Decision Filter. Documented policies.

2019: Score 3 — Shared frameworks with family. Used them to evaluate deals. Started family meetings.

2023: Score 4 — Sons actively engaged. Oldest learning options portfolio. Family board meetings quarterly.

Score yourself:

0: Make decisions alone. No framework. React to opportunities.

1: You know you need a framework. Nothing documented.

2: Decision matrix created. Not consistently using it.

3: Framework in use. Family aligned. Decisions are systematic.

4: Family operates independently using frameworks. Succession active.

What I see most often: People give this power away to advisors. They’re supposed to get advice, but instead become reliant. The advisor makes the decisions; the client just approves. That’s not governance—that’s dependence. You should be the CEO making strategic decisions. Advisors execute.

Your score: ___

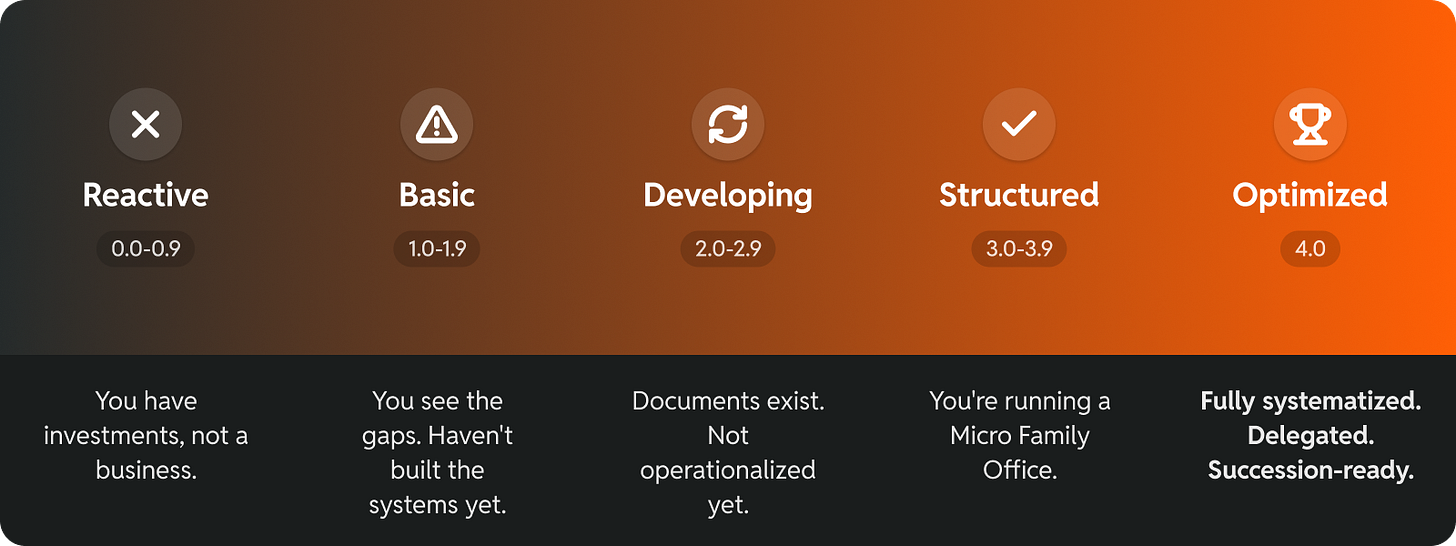

Calculate Your Overall Score

Add up your 7 component scores: ___

Divide by 7 to get your average: ___

Your MiFO Readiness Level:

What Your Score Means

0.0 - 0.9: Reactive (You Have a Portfolio)

What you have: Assets. Accounts. Maybe an advisor. But no infrastructure around them.

What you’re missing: Everything. You’re managing a portfolio, not running a business.

Next step: Start with Component 1 (Vision). Write your legacy statement this week. One sentence: Why does this wealth exist?

1.0 - 1.9: Basic (You See the Gaps)

What you have: Awareness. You’ve identified what’s missing. Some thinking done.

What you’re missing: Documented plans and execution.

Next step: Pick your weakest component. Create the document. Legacy statement, Investment Thesis, Entity Plan—whatever you scored 0 or 1 on.

2.0 - 2.9: Developing (You Have Plans)

What you have: Documents. Frameworks. Plans. They exist on paper.

What you’re missing: Operationalization. The documents aren’t running yet.

Next step: Share ONE document with your family this week. Investment Thesis with your spouse. Entity plan with your CPA. Make it real.

3.0 - 3.9: Structured (You’re Running It)

What you have: A functioning Micro Family Office. Systems operational. Decisions systematic.

What you’re missing: Full delegation and optimization.

Next step: Identify one manual process you’re still doing. Delegate it. Get one component to 4.

4.0: Optimized (Succession-Ready)

What you have: A complete, systematized, delegated wealth business.

What you’re missing: Nothing. You’ve built it.

Next step: Focus on succession. Teach the next generation to run what you’ve built.

My Score in 2016 vs 2024

It took 8 years. Not because it’s complex. Because I had to figure it out myself.

You don’t have to.

What’s Next

You just identified your gaps.

Next week: I’ll show you what each of the 7 MiFO Components looks like when it’s actually running—and which one is costing you the most by being missing.

One component at a time. From awareness to execution.

Your Action This Week

Do the assessment. Score yourself honestly on all 7 components.

Identify your weakest component. Where did you score 0 or 1?

Commit to one action. If Vision = 0, write your legacy statement. If Legal = 0, research Holding Company formation. If Operations = 0, hire a bookkeeper.

One action. This week.

That’s how portfolios become businesses.

—Christopher

P.S. When I scored myself in 2016, I had a 0.4. Reactive across almost every component. That score wasn’t depressing—it was clarifying. I finally knew where to start. Your score isn’t a judgment. It’s a map.

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.