CPAs Handle Compliance, But Tax Planners Save You Money—Here's How

Do You Have a Tax Preparer or a Tax Strategist? Here's Why It Matters

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

💼 The costly difference between tax preparation and proactive tax planning

🧾 How Certified Tax Planners (CTPs) help tech professionals legally keep more of their RSU income

📊 A step-by-step framework to build your own tax strategy team before December 31

Hey Portfolio CEOs,

I’ll never forget sitting at my desk in 2012, staring at a spreadsheet that made my stomach turn.

90% of my net worth was locked up in Splunk stock. The IPO lockup period was ending. My ISOs were vesting. And I was about to make what would become a very expensive mistake.

My CPA’s advice? “Let me know when you sell, and we’ll handle it on your tax return.”

That sounded reasonable at the time. After all, that’s what CPAs do, right?

Wrong.

By the time I filed my taxes that year, I’d paid tens of thousands more than I needed to.

Not because my CPA did anything wrong. But by the time we were sitting in his office in March, preparing my return, every single tax-saving opportunity from the previous year was gone.

That expensive lesson taught me something most tech professionals with equity compensation learn the hard way: There’s a massive difference between tax preparation and tax planning.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m breaking down what it really takes to move from the top 10% to the top 1%—and why $1M no longer means financial freedom.

Wealth vs. Freedom: Why $1M isn’t enough to stop working in today’s world

Net Worth Benchmarks: The real numbers behind the top 10%, 5%, and 1%

The Great Decoupling: How the top 1% shift from assets to capital and systems

House-Rich vs. Capital-Rich: Why most people are stuck with income-less wealth

Play a Different Game: Because breaking into the top 1% takes more than growing net worth—it takes transforming how you build and manage it

The Problem We Don’t Even Know We Have

Here’s what typically happens when you’re a successful tech professional:

You work hard. You climb the ladder. You start making serious money—maybe $300K, $500K, even $800K+ when you factor in RSU vests and bonuses.

At some point, your partner or a colleague says, “You should get a CPA.” So you do. You hire someone. They’re professional. They file your taxes accurately. You pay them $1,500 and feel good that you’ve got a “financial professional” on your team.

And every year, like clockwork, you get a tax bill that makes you wince. You pay it. You move on. You assume this is just how it works when you make good money.

But here’s what you don’t realize: Your CPA is playing defense. You need someone playing offense.

Let me explain.

Your CPA Is a Historian, Not a Strategist

CPAs are incredibly valuable. I have one. I’m not bashing the profession.

But CPAs are trained for compliance. They’re experts at:

Filing accurate tax returns

Navigating complex tax codes

Defending you in an audit

Making sure you don’t get penalized by the IRS

Think of your CPA like a QA engineer. They catch bugs after the code is written. They make sure nothing breaks. They’re essential for shipping quality software.

But here’s the thing: You don’t call your QA engineer to architect your entire system.

That’s the problem.

When your CPA is your only tax professional, you’re getting compliance without strategy. You’re getting accurate reporting of what happened last year without proactive planning for this year.

The Distinction That Changed My Wealth Trajectory

After my expensive 2012 lesson, I started researching how ultra-wealthy families ($30M+ net worth) handle taxes.

What I discovered shocked me.

They don’t rely on CPAs alone.

Every Single Family Office I studied had tax strategists—professionals whose entire job is proactive, year-round tax planning.

These weren’t the same people preparing tax returns. They were Certified Tax Planners (CTPs) or enrolled agents specializing in tax strategy.

Here’s the fundamental difference:

A CPA tells you what you owe. A Certified Tax Planner shows you how to legally owe less.

Let me break this down with a framework that made it click for me.

CPA vs. Certified Tax Planner: The Real Differences

Certified Public Accountant (CPA)

Focus: Tax compliance and preparation

Timing: Backward-looking (preparing last year’s taxes)

Relationship: Seasonal (January through April, minimal contact the rest of the year)

Expertise: Tax code compliance, accurate filing, audit defense

Best for: Making sure you file correctly and don’t get audited

Typical CPA questions:

“What income did you have last year?”

“Do you have receipts for these deductions?”

“Did you receive any 1099s we need to report?”

Certified Tax Planner (CTP)

Focus: Proactive tax strategy and optimization

Timing: Forward-looking (planning THIS year and beyond)

Relationship: Year-round strategic partnership

Expertise: Tax code optimization, equity compensation strategy, multi-year planning

Best for: Minimizing lifetime tax burden through strategic planning

Typical CTP questions:

“What’s your RSU vesting schedule for the next 3 years?”

“Have you considered bunching your charitable deductions?”

“What’s your optimal ISO exercise amount to minimize AMT?”

“Should we set up a holding company for your investments?”

See the difference?

One is reactive. One is proactive.

One looks backward. One looks forward.

One accepts the tax bill. One designs around it.

Where This Costs Tech Professionals Real Money

Let me give you specific scenarios where having only a CPA costs you five to six figures over your career.

Scenario #1: The RSU Vesting Event

You’re a Director at a tech company. You have $500K in RSUs vesting in Q1.

With only a CPA:

RSUs vest, $500K counts as ordinary income

You pay full income tax at your marginal rate (let’s say 35% federal + 10% state = 45%)

Tax bill: $225K

Your CPA files this in April and says, “Yep, that’s what you owed”

With a Certified Tax Planner:

In Q4 of the prior year, your CTP models this scenario

They identify $40K in potential tax-loss harvesting opportunities in your portfolio

They recommend bunching 3 years of charitable giving ($60K) into this high-income year via a DAF

They time other deductible expenses to hit this year

Result: You still report $500K in income, but your taxable income drops to $400K

Tax savings: $35-50K

That’s $35-50K that stays in your portfolio instead of going to the IRS. Legally. Ethically. Just through proactive planning.

Scenario #2: The ISO Exercise Disaster

You joined a startup 5 years ago. You have ISOs that are now in the money. The company might go public soon.

With only a CPA:

You exercise all your ISOs at once because you’re excited

Massive Alternative Minimum Tax (AMT) bill hits

Your CPA calculates it in April

You owe $200K+ in AMT

You might even trigger AMT on “phantom income” if the stock value drops later

With a Certified Tax Planner:

Your CTP calculates your AMT “crossover point”

They model a multi-year exercise strategy

You exercise just enough each year to stay below AMT triggers

You spread the exercise over 3-4 years

Total tax savings: $75-150K+

This is the difference between understanding tax strategy BEFORE you make decisions vs. calculating the damage AFTER.

The Lifetime Impact

Here’s the math that keeps me up at night (in a good way now):

Over a 20-year tech career, the difference between tax preparation and tax planning compounds.

Tech professional with only a CPA: Pays an effective 35-40% tax rate over their career

Same tech professional with a CTP: Pays an effective 25-30% tax rate through proactive strategies

On $10M of lifetime earnings, that’s a $500K-$1M difference.

That’s not money you save once. That’s money that compounds in your portfolio over decades.

But Here’s What Nobody Tells You

The financial services industry doesn’t make this distinction clear.

When you search for “tax help,” you find CPAs. When you ask your wealth manager, they might say, “Oh, we work with CPAs” or “We have CPAs on staff.”

But that’s not the same as having a Certified Tax Planner who’s working year-round to optimize your specific situation as a tech professional with equity compensation.

Why doesn’t your wealth manager suggest a CTP?

Because most wealth managers are focused on managing your portfolio, not optimizing your tax situation. And frankly, many don’t understand the nuances of equity compensation well enough to recommend specific tax strategies.

Ultra-wealthy families figured this out decades ago. They built teams where everyone has a specific function:

CPA for compliance

Tax strategist for planning

Estate attorney for legacy planning

Chief Investment Officer for investments

As tech professionals building Micro Family Offices, we need the same systematic approach—just scaled for our $1M-$30M net worth instead of $100M+.

How to Know If You Need a Certified Tax Planner

Ask your current CPA these questions:

“Can you help me model different RSU sale scenarios BEFORE I execute them?”

“What’s my optimal ISO exercise amount this year to minimize AMT?”

“How should I structure my charitable giving for maximum tax benefit across multiple years?”

“Should I set up an entity structure for my portfolio management?”

“What’s our proactive tax strategy for the next 3-5 years?”

If they say, “We’ll figure that out when we file your return” → You need a Certified Tax Planner.

If they say, “Let me run those scenarios for you” → Great! You might already have strategic tax planning built in.

If they say, “That’s not really what we do” → That’s fine! They’re being honest. But you need to add a tax strategist to your team.

Finding a Certified Tax Planner (The Practical Steps)

Here’s what I recommend:

Look for the CTP designation (Certified Tax Planner through the American Institute of Certified Tax Planners) or enrolled agents who specialize in tax strategy.

Ask about their experience with equity compensation:

“How many tech clients do you work with?”

“What’s your experience with RSU tax planning?”

“How do you handle ISO exercise strategy?”

“Have you worked with clients managing concentrated stock positions?”

Confirm year-round engagement:

“Do you work with clients throughout the year or just during tax season?”

“What does a typical annual engagement look like?”

“How often would we meet to review and adjust strategy?”

Frame this as an ROI conversation, not a cost conversation:

Here’s the mindset shift I had to make: You’re not looking for a service provider. You’re looking for a strategic partner where the relationship is measured by return on investment.

Let me show you the math:

Your current CPA costs: ~$4,000/year for compliant tax returns

Adding strategic tax planning: ~$10,000/year total ($6K for the CTP, $4K for CPA compliance)

Tax savings from proactive strategies: $30,000+ (very achievable with equity compensation)

Net benefit: $20,000 in your pocket.

You’re investing an additional $6K to generate $30K in savings. That’s a 5x return. Where else are you getting those odds?

But here’s the critical part most people miss: You have to own and drive getting that ROI back.

This isn’t a passive relationship where you hand everything over and magically save money. This is a strategic partnership where:

They bring expertise in tax code, strategy design, and proactive planning

You bring ownership of implementing their recommendations, providing timely information, and making decisions

When you interview CTPs, ask directly:

“Walk me through how much clients typically save vs. what they pay you”

“What’s the expected ROI on your services for someone in my situation?”

“What do I need to do to maximize the value of working together?”

The best tax strategists will be completely transparent about this. They’ll tell you, “If we can’t save you at least 3-5x what you’re paying me, this engagement doesn’t make sense.”

If they can’t articulate the ROI conversation, move on.

Red flags to watch for:

They only talk to you January through April

They don’t understand equity compensation

They can’t explain strategies in clear terms

They promise “guaranteed” results (tax planning isn’t magic)

They can’t articulate a clear ROI framework for the engagement

The Integration Strategy (What I Actually Do)

In my Micro Family Office, here’s how the team actually works:

My Bookkeeper: Handles all the books throughout the year. They track income and expenses, reconcile accounts, and close my books monthly. This gives me clean, organized financials ready for tax planning.

My Certified Tax Planner: Receives the closed books from my bookkeeper and does two critical things:

Year-round tax strategy - We meet quarterly to model scenarios, optimize my equity compensation decisions, and plan proactive tax moves

Tax filing and compliance - They prepare and file my returns using the clean books from my bookkeeper

This is the most cost-effective setup I’ve found.

Here’s why: Instead of paying a CPA $4K just for compliance AND a separate tax strategist $6K for planning, I’m paying one firm that does both. My CTP handles the strategic planning throughout the year and the tax preparation at filing time. The bookkeeper keeps everything organized and costs a fraction of what a full accounting firm would charge.

The bookkeeper makes sure the CTP has clean data. The CTP uses that data for both strategy and filing. No duplicate work. No information getting lost between providers. One streamlined system.

Total annual investment:

Bookkeeper: ~$3-5K/year

CTP (strategy + filing): ~$8-12K/year

Total: $11-17K/year

Return: $30-50K+ in annual tax savings

That’s still a 3-5x ROI, and it’s operationally cleaner than having three separate professionals trying to coordinate.

This is exactly how ultra-wealthy families operate. I’ve just adapted it for my situation as a tech professional managing an 8-figure portfolio—lean, efficient, and systematized.

The December 31 Deadline Reality

Here’s the hard truth if you’re reading this in late November or December:

Most tax strategies must be executed BEFORE December 31.

Once January 1 hits, your opportunities for 2025 are locked. You can’t go back and:

Harvest losses from 2025

Make charitable contributions for 2025 deductions

Execute Roth conversions for 2025

Time business expenses for 2025

This is exactly why ultra-wealthy families keep tax strategists on retainer year-round. They’re not scrambling in December. They’ve been executing a systematic plan all year.

If you’re reading this and realizing you’ve been relying only on a CPA, you’re not behind. You’re just learning a better system. But the clock is ticking for 2025 optimizations.

Your Action Plan for the Next Two Weeks

This week:

Schedule a call with your current CPA

Ask them the 5 questions I listed above

If they’re not providing strategic tax planning, start researching Certified Tax Planners in your area (or who work virtually)

Next week: 4. Have initial consultations with 2-3 CTPs 5. Ask about their experience with tech professionals and equity compensation 6. Understand their fee structure and year-round engagement model

Before December 31: 7. Even if you don’t have a CTP yet, schedule a year-end tax strategy session with your current CPA 8. At minimum, ask: “What strategies can we execute before year-end to optimize my 2025 taxes?” 9. Mark your calendar for Q1 2026: This is when you build your proper tax strategy for next year

The Micro Family Office Mindset

This is the “Build” phase of WealthOps—assembling the right team for the right functions.

Every Single Family Office has:

A tax strategist (not just a tax preparer)

Bookkeepers

A CPA

An estate attorney

Chief Investment Officer

and more

Your Micro Family Office needs the same structure. You just scale it to your $1M-$25M net worth and use a combination of retained professionals and your own systematic processes.

The goal isn’t to spend more on professional fees for the sake of it. The goal is to spend strategically on expertise that returns multiples on your investment.

A Certified Tax Planner who saves you $40K annually while charging $6K is almost a 7x return. Show me another investment with those odds that doesn’t add more risk to your portfolio.

My Ask for You

I’d genuinely love to hear from you:

Do you work with a Certified Tax Planner? If so, what’s been your experience? How much have they saved you?

If you only have a CPA, what’s been your biggest challenge with tax planning?

Have you encountered resistance when asking your CPA about proactive strategies?

Hit reply with your experiences—the good, the bad, and the expensive lessons.

I reply to all emails!

Best / Christopher

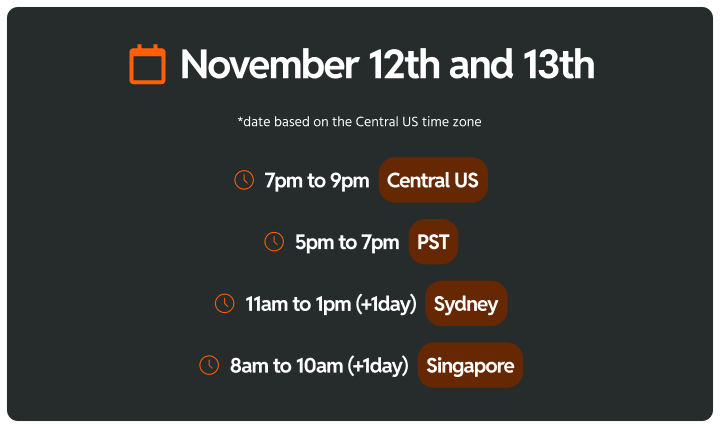

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.

Hi Christopher, I am a 75-year-old retired business owner, I am not keen on computer tech, founding you through YouTube, through many hurdles, found your channel, this post is what I really need now. During the reading and printing (by section, so I can take action immediately), I keep bursting out my deep gratitude to you, thank you very much !!! for sticking on your core value-serve educate and connect, and create this interactive community.

Your practical guidance, already help me tremendously on action part. I have signed up 12/17 workshop. but feel can't wait for almost a month.

I am ready for a bigger move- create a New Family Blueprint for me and my children to be effectively utilizing our strength contribute to the world to form an Economy of Caring society.

There are lots of detail need to be set up, and your Micro Family Office model fit right into my inner requirement- from vision to systematic process to lasting legacy.

Would like to talk with you to see if I am qualifying for your coaching on this journey

thank again

Christine Yu-Mei Chen