How I Lost 25% of My IPO Wealth in 30 Days (And Why I'm Grateful)

Your concentration risk wake-up call starts now

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

🧠 What six months of forced observation taught about concentration risk

📈 How covered calls and mechanical diversification boost returns safely

🎯 The step-by-step approach to transition from reactive to systematic investing

Hey Portfolio CEOs,

The Day That Changed Everything

April 19, 2012. 9:30 AM EST.

Splunk goes public. My equity? Worth just over $3 million at $34 per share.

For the first time in my life, I'm a multi-millionaire. On paper.

Then came those two words that would teach me more about wealth than any MBA ever could: Lockup period.

For six months, I could only watch. No selling. No diversifying. No control.

Just watching.

The Emotional Torture Chamber

Here's what those six months looked like from inside my prison:

📉 May: Down to $32.56

"It's just market adjustment. Stay calm."

📉 June: Crashes to $28.10

"Okay, this hurts. But IPOs are volatile, right?"

📈 July: Slight recovery to $29.40

"See? I knew it would bounce back!"

📈 August: Back to $34.40

"We're golden again. October can't come fast enough."

🚀 September: Rockets to $36.72

"NEW HIGHS! I'm a genius for holding!"

💥 October: Craters to $28.03

24% gone. $800,000 evaporated. In 30 days.

My lockup doesn't end until October 17th and the first trading window opened in December.

I'm watching my family's future disappear, and I can't click a single "sell" button.

Our first child had just been born. We needed that house. We needed stability.

Instead, I got a masterclass in concentration risk.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m exposing the middle-class money mindset trap—and how it’s quietly sabotaging the wealth of first-generation millionaires.

More Money, Same Mindset: Why earning millions doesn’t upgrade your financial strategy

From Scarcity to Systems: The shift that helped me stop treating millions like thousands

5 Key Differences: How wealthy thinkers approach taxes, time, teams, and legacy

Income vs. Net Worth: Why the guy with less money can have more freedom

Your Next Step: How to transition from accumulation to building a Micro Family Office

The $1.8 Million Cautionary Tale

Think my story is bad? Let me tell you about Mike.

Fresh out of college, Mike joins a large chip manufacturer. Works his ass off for four years. His RSUs grow to nearly $2 million.

"Let it ride," he thinks. "The company's crushing it."

Then litigation hits. Some patent dispute that shouldn't even matter.

The stock starts bleeding:

At $1.5M: "It'll recover"

At $1M: Paralysis sets in

At $500K: Pure panic

He sells everything at $200K.

$1.8 million. Gone.

Not because the company failed.

But because he had no plan when emotion took over.

When you literally CAN'T sell, you start asking different questions:

What would I do if I could act right now?

How much am I really comfortable losing?

What's my actual plan when this ends?

Most people never ask these until it's too late. I had six months of forced contemplation.

That torture became my education.

The Four Pillars of Portfolio Protection

Before my lockup ended, I went on a mission. Talked to everyone who'd survived market crashes, lock ups and overconcentration.

Here's what actually works:

1. Fire Your CPA, Hire a Tax Strategist

CPA: "You owe $500K in taxes"

Tax Strategist: "Here's a strategy to reduce this year to $300K instead, and let’s plan next year now to lower it even further."

The difference? One reports history. The other creates strategy.

Find someone who knows:

10b5-1 Scheduled Selling

Exchange fund strategies

Capital Loss Strategies (Direct Indexing, Crypto Wash Sales)

Donor-advised funds (Balance Sheet Giving)

Moving to a Tax Strategist alone saved me multiple six figures.

2. Define Your "Go Long" Number

Here's the mental model that changed everything for me:

Decide RIGHT NOW how much you're willing to go to zero with.

Not "hold long term." Not "believe in the company."

How much are you willing to watch disappear completely and still sleep at night?

For me, after watching that $800K evaporate in October 2012, I realized my number is 10% of my net worth. That's my "go long" allocation. I can believe in my company with 10% and protect my family with the other 90%.

Once you hit your number, everything else is systematic diversification. No emotion. No "one more quarter." Just execution.

3. Generate Income While You Exit

This one shocked me: You can generate income WHILE reducing concentration.

Covered calls became my best friend. Here's the simple version:

Own 1,000 shares at $30 = $30K

Sell monthly calls at $33 strike = collect $600 premium

Stock stays below $33? Keep shares + $600

Stock goes above $33? Shares sold at profit + keep premium

I was collecting 2-3% monthly "rent" on my stock while executing my diversification plan. That's 24-36% annual return on top of any appreciation.

The beauty? If the stock gets called away, that's not a bug – it's a feature. You're diversifying at a profit.

4. Make It Mechanical, Not Emotional

My system:

Here's my actual diversification system – the one that saved my wealth:

The Mechanical Method:

Quarter 1: Calculate total position value

Quarter 2: Sell 10% regardless of price

Quarter 3: Review and rebalance

Quarter 4: Sell another 10%

Annual: Update strategy based on life changes, but NEVER skip a quarter

No emotions. No market timing. No "feelings" about where the stock is headed.

This is a coordinated plan executed with my Tax Strategist.

When Splunk hit $40 in March 2013, did I want to hold everything? Of course. But the plan is the plan.

The Truth That Changes Everything

Wealth is created through concentration.

Wealth is kept and grown through diversification.

Your concentrated position got you here. Respect it.

But don't let it destroy you.

I watched my wealth swing 43% based purely on timing. If I'd needed money in June 2012 ($28) versus March 2013 ($40), that's the difference between security and struggle.

That's not investing. That's gambling with your family's future.

Your Wake-Up Call Moment

I was lucky. My wake-up call came during a lockup when I couldn't act anyway. It taught me the lesson without destroying me.

Mike wasn't so lucky. His $1.8M tuition was non-refundable.

You get to choose which story yours resembles.

If you're sitting on concentrated equity right now, reading this newsletter IS your wake-up call.

Are you going to be the person who diversifies at $36.72? Or the one panic-selling at $28.03?

The market won't give you six months to think about it like my lockup did.

Here's exactly what to do this month:

Week 1: The Reality Check

Calculate your exact concentration percentage

Look up your stock's 52-week high and low (feel that range?)

Write down your "go long" number

Week 2: The Team

Interview 3 tax strategists (not CPAs)

Find one who speaks "equity compensation"

Book your strategy session

Week 3: The Plan

Create your mechanical selling system

Set calendar reminders for quarterly execution

Research covered call strategies for income

Week 4: The First Move

Execute your first 10% sale

No excuses, no delays

Celebrate taking control

The Bottom Line

You worked incredibly hard for this wealth. Years of late nights. Missed family dinners. Postponed vacations. All for those RSUs that finally paid off.

Now work just as hard to protect and grow it.

My Splunk lockup disaster – watching $800K disappear while handcuffed – gave me something worth far more: A systematic approach to wealth that's protected and grown my portfolio for over a decade.

Your concentrated position won't warn you before it drops. The market won't ring a bell at the top. Your company won't email you before bad news hits.

The time to diversify is now. While you still can. While it still feels unnecessary.

Because by the time it feels necessary, it's already too late.

Ask anyone who held from $36.72 to $28.03.

Stay systematic (and diversified),

Christopher

P.S. I know someone reading this is sitting on 90% concentration right now, thinking they're different. That their company is different. That they'll know when to sell.

I thought the same thing watching Splunk rise from $34 to $36.72 in September 2012. One month later, I'd lost $800K. The only difference? I couldn't panic sell. You can. Which story do you want to tell in five years?

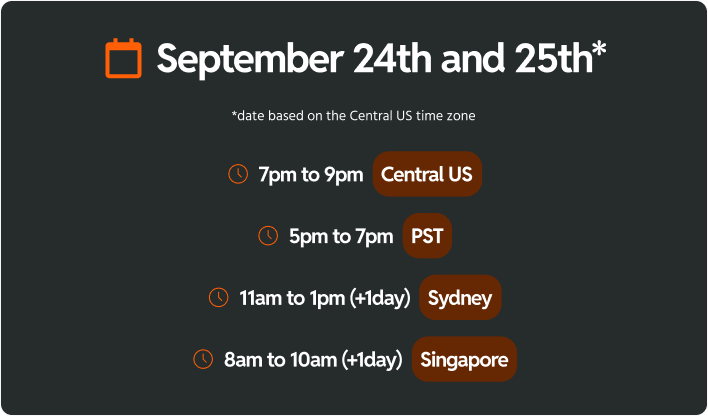

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.