The 5 Wealth-Building Habits Tech Professionals Think Are Smart (But Are Actually Keeping Them Broke)

Why following conventional wisdom is costing you millions

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

💸 Why common “smart” financial habits actually hold tech professionals back

📈 How systematic selling and strategic diversification protect your portfolio

📊 The actionable steps to replace middle-class playbooks with wealth-building strategies

Hey Portfolio CEOs,

You’re doing everything “right” according to the financial playbooks. Maxing your 401(k). Diversifying broadly. Following the sacred rules of r/personalfinance.

Yet you’re still living paycheck to paycheck on $400K total comp.

Here’s the uncomfortable truth: The financial advice that works for most Americans is actually toxic for tech professionals with equity compensation.

You’re following a playbook written for people making $75K, not those sitting on $2M in RSUs.

Today, I’m calling out the five “smart” habits that are actually keeping you trapped in the middle-class mindset while your net worth screams upper class.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m sharing the 3-phase blueprint I used to scale my portfolio past $8M—and generate $200K+ in passive income every year.

The IPO Wake-Up Call: Why traditional advisors gave me 401k advice after a $3M windfall

The Financial Dead Zone: The hidden cost of staying stuck between $1M and $10M

Architect, Build, Run: The Micro Family Office framework that changed everything

Think Like an Operator: How systems and fractional experts simplify wealth management

Clarity Over Chaos: Because real financial freedom comes from structure—not guesswork

Habit #1: Maxing Your 401(k) Before Building Real Liquidity

What you’ve been told: “Always get the company match! Max out your 401(k)! It’s free money!”

Why it’s keeping you broke: You’re locking up $23,000/year in an account you can’t touch until 59½ while your RSUs create massive tax bills TODAY. When that $400K tax bill hits from your vest, your 401(k) can’t help you. You’re forced to sell RSUs at the worst possible time—often during a market dip—just to pay taxes.

The reality check: One client had $2M in his 401(k) but had to sell $300K in RSUs during a 30% dip to cover taxes. That panic sale cost him $500K in future gains. His “smart” retirement savings forced a terrible investment decision.

What to do instead: Build a tax reserve fund first. Yes, before maxing retirement accounts. Hold 6-12 months of estimated taxes in liquid investments. Only then max retirement accounts. Your 401(k) is dessert, not the main course.

Habit #2: Holding ISOs for Long-Term Capital Gains

What you’ve been told: “Hold for a year! Save 20% on taxes!”

Why it’s keeping you broke: You’re taking massive concentration risk to save on taxes. While you’re waiting for that one-year mark, you’re watching 90% of your net worth ride on one company’s stock price. The tax tail is wagging the investment dog.

The reality check: I watched a friend hold ISOs through a 70% decline to get long-term treatment. He saved $100K in taxes but lost $700K in value. Another exercised and sold immediately, paid full taxes, and reinvested. She’s up $2M on the diversified portfolio.

What to do instead: Run the AMT calculation. If exercising triggers AMT, consider selling enough to cover it immediately. Take the tax hit and diversify. A diversified portfolio growing at 12% beats a concentrated position hoping for 20% tax savings.

Habit #3: Over-Diversifying Into 20+ Index Funds

What you’ve been told: “Diversification is the only free lunch!”

Why it’s keeping you broke: You’ve got 20 index funds that all basically do the same thing. VTSAX, VTIAX, VOO, SPY, QQQ... congratulations, you’ve created an expensive S&P 500 replica. Meanwhile, you’re missing the investments that actually create wealth: alternatives, private equity, real estate.

The reality check: Your portfolio: 95% public equities across 20 funds, all correlated. Wealthy portfolio: 40% public equities (3 funds), 60% alternatives.

You’re diversifying within one asset class while ignoring five others.

What to do instead: Simplify public markets (3-4 total funds max). Use the mental bandwidth you save to explore real diversification: private credit, real estate funds and syndications, and other income-generating assets. True diversification means different asset classes, not different flavors of the same thing.

Habit #4: Waiting for the “Perfect” Market Timing

What you’ve been told: “Time in the market beats timing the market!”

Why it’s keeping you broke: You parrot this phrase while simultaneously holding 80% of your net worth in company stock, waiting for “the right time” to diversify. You’re accidentally timing the market with your biggest position while preaching against it with your smallest.

The reality check: “I’m waiting for the stock to recover” = market timing “I’ll sell after the next earnings” = market timing “Let me hit the one-year mark” = tax timing disguised as market timing

Meanwhile, systematic selling (10% per quarter regardless of price) consistently outperforms “waiting for the right moment.”

What to do instead: Create a systematic selling schedule. Same date every quarter. Same percentage. No exceptions. Remove emotion and decision-making from the process. Boring? Yes. Effective? Absolutely.

Habit #5: Following r/personalfinance Like It’s Scripture

What you’ve been told: “The flowchart is all you need! Index and chill!”

Why it’s keeping you broke: r/personalfinance is optimized for median American income ($75K) and zero equity compensation. Their emergencies are job loss. Yours are AMT bills. Their investment options are Vanguard funds. Yours include pre-IPO shares and GP stakes.

The reality check: Following generic advice with specific wealth is like using a Honda manual to maintain a Ferrari. Sure, they’re both cars, but the optimization strategies are completely different.

r/pf says: 6-month emergency fund

You need: 12-month tax reserve + 6-month expenses

r/pf says: Index funds only

You need: Alternative investments for real diversification

r/pf says: Pay off all debt

You need: Strategic leverage for wealth multiplication

What to do instead: Graduate from r/personalfinance to communities built for your situation. Join networks of tech professionals managing real wealth. Stop taking advice from people managing different problems.

The Bottom Line

These “smart” habits aren’t wrong—they’re just wrong for YOU.

They’re designed for steady salaries, not volatile equity. For simple taxes, not AMT calculations. For retirement in 30 years, not financial independence in 10.

Every year you follow generic advice with specific wealth is another year you delay your freedom.

The question isn’t whether these habits worked for others. It’s whether they’re working for you.

Look at your last five years. Are you closer to financial independence or just older with a bigger 401(k) balance you can’t touch?

Here’s to unlearning what’s keeping you broke,

Christopher

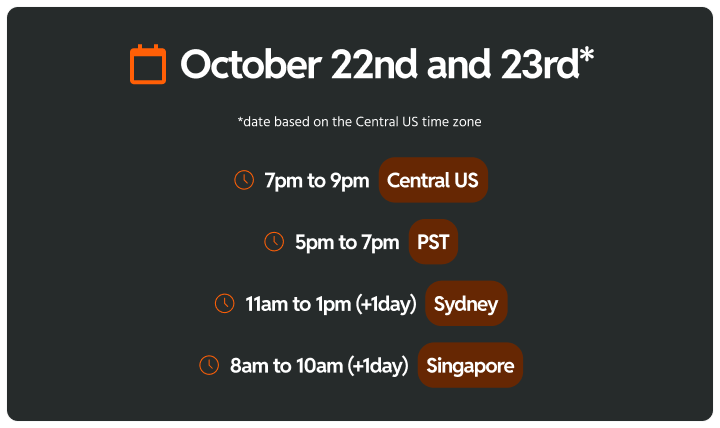

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.