Ultra-wealthy investors do this FIRST—before making a dime

And most people skip it completely—at their own risk.

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Tuesday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Our mission is to demystify equity compensation, investment strategies, and financial independence for tech professionals.

How I Discovered the Power of Architecture in WealthOps

In 2012, I found myself standing at a financial crossroads.

I had just gone through an IPO and found myself with a significant windfall. On the surface, it seemed like I was living the dream. But 90% of my wealth was tied up in a single stock, and I had no plan, no strategy—just a growing sense of panic that it could all disappear.

My financial future felt less like an opportunity and more like a ticking time bomb.

Traditional wealth managers couldn’t help me.

Their advice was painfully predictable: diversify into stocks and bonds, play it safe, and follow the 4% withdrawal rule. I knew that wasn’t going to cut it.

I didn't want a draw-down portfolio with the end goal to drain it and pray I have some left over.

Why couldn't I have a portfolio that the Ultra Wealthy have?

A portfolio with consistent income—8%, 9%, even 10% cash-on-cash returns—so I could replace my paycheck and build real freedom.

The ultra-wealthy weren’t following that same rulebook, and I wasn’t about to either.

That’s when I realized I needed a whole new blueprint.

The Moment It All Clicked

The ultra-wealthy always start by defining their legacy.

I networked like crazy, studying how these family offices operated.

The first thing I learned hit me like a lightning bolt: before they invest a dime, they write a legacy statement. It’s not about money; it’s about purpose. Their why becomes their compass—a guide for every decision they make. At first, it felt fluffy, like something from a motivational workshop.

But the more I thought about it, the more I realized how essential it was.

Without a clear purpose, how could I know if I was even building the right portfolio?

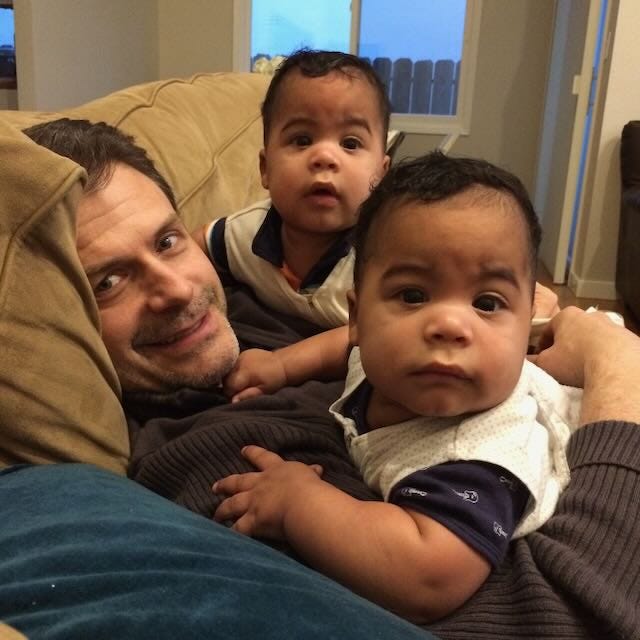

One day, while watching my sons play in the backyard, the answer became obvious. My why wasn’t complicated. It was right in front of me the whole time:

I wanted financial independence so I could walk with my sons on their journey from boys to men. I wanted to be fully present for the moments that mattered.

And once they left home, my wife and I would live life on our terms—travel, experience, and work on meaningful impact projects.

That realization changed everything. Suddenly, this wasn’t about spreadsheets or market trends. It was about designing a life that aligned with what mattered most.

I had my why. Now, I needed a plan.

Turning Purpose into Strategy

A legacy statement is the foundation, but an investment thesis is the roadmap.

Once I had clarity, I started setting real goals: how much income I needed, how much risk I could handle, and what combination of assets would get me there.

I quickly realized I couldn’t just guess. I needed to architect my portfolio—carefully and intentionally.

This is what I now call the Architect Phase of WealthOps.

It’s where everything begins.

For the first time in years, I felt free. I wasn’t living in fear of losing everything. I knew exactly what I was building and why.

The chaos turned into control, and I had a clear direction.

Unlocking the Full Picture

Clarity gave me the energy and confidence to keep going.

I took my vision and turned it into a living, actionable strategy. I built an investment thesis, translating my goals into a plan that aligned my assets with my purpose.

Every decision became easier.

Every step took me closer to the life I was designing.

It wasn’t always easy, but it was simple. O

nce the architecture was in place, the pieces started falling together.

This structure became my blueprint for managing my wealth, and today it’s the same framework I teach in WealthOps.

Without a plan, you’re always stuck in reactive mode.

With a clear architecture, you take control and build a life that aligns with your biggest dreams.

Start with your why. Everything else will follow.

The Four Questions to Build Your Investment Thesis

The WealthOps Architect process follows a deliberate sequence designed to ensure that every financial decision is purpose-driven, measurable, and aligned with long-term goals.

What Is an Investment Thesis?

An investment thesis is your game plan for wealth—a clear, structured framework that defines why, what ,how , and where you invest.

The ultra-wealthy don’t invest randomly; they follow a written policy that lays out their objectives, risk tolerance, and portfolio strategy. This keeps their decisions aligned, disciplined, and intentional, instead of chasing the latest trends.

For Ultra-High-Net-Worth (UHNW) families, this process is handled by family offices—a team managing everything from investments to taxes and risk. But most people don’t have a full-scale family office at their disposal.

This prevents common mistakes like investing reactively, chasing returns without a clear purpose, or misallocating assets in ways that don’t support your desired lifestyle.

How WealthOps Turns a Complex Family Office Process Into 4 Simple Steps

WealthOps cuts through the noise and distills what the ultra-wealthy do into 4 key steps, making it simple, strategic, and actionable:

1️⃣ WHY – Define Your Legacy Statement

→ Get crystal clear on what you're building and why. Your wealth should support your freedom, lifestyle, and impact—not just grow for the sake of growing.

2️⃣ WHAT – Set Your Financial Outcome Goals

→ What do you actually need from your portfolio? Cash flow? Long-term growth? Security? Define the mix of assets that will get you there.

3️⃣ HOW – Measure What Matters

→ Without clear benchmarks, you’re just guessing. Track key performance metrics so you stay on course and adjust with confidence.

4️⃣ WHERE – Allocate Assets Strategically

→ This is where you put your money to work. Instead of chasing investments, structure your portfolio like a business, ensuring balance, diversification, and tax efficiency.

💡 The Bottom Line: Instead of hiring a full team to do this for you, WealthOps hands you the playbook—so you can run your portfolio like a pro, without the complexity.

From Simple Steps to Strategic Execution

Understanding the four simple steps to building a strong investment thesis is just the beginning. The real power comes from asking the right questions at each stage—because without clarity at the foundation, everything else crumbles.

Think of it like constructing a skyscraper:

If you skip the blueprint (WHY), you risk building something that doesn’t serve your needs.

If you don’t define the structure (WHAT), you may end up with an unstable foundation.

Without clear checkpoints (HOW), you won’t know if you’re on track.

And if you don’t place the right materials in the right places (WHERE), the entire structure could collapse under its own weight.

💡 That’s why executing these steps in the right order is critical.

Now, let’s break down the key questions you should be asking at each stage—and why each step builds on the last. 👇

✔ WHY am I building wealth? (Legacy Statement)

Why It’s Important:

Without a clear WHY, wealth-building becomes directionless—leading to wasted time, unnecessary risk, or money without meaning.

Your WHY ensures that wealth isn’t just about accumulating assets—but about creating a life that aligns with your values, relationships, and priorities.

It defines what success looks like beyond a number.

Why This Comes First:

Every investment decision should be anchored in your personal definition of success.

Without a WHY, you may choose investments that conflict with your true goals (e.g., prioritizing aggressive growth when you really need stability).

This step prevents decision fatigue by filtering out financial opportunities that don’t align with your vision.

Example: If your WHY is to spend more time with your family, you may focus on income-producing investments over high-risk, long-term growth strategies.

✔ WHAT financial outcomes do I need? (Asset Category Goals)

Why It’s Important:

Not all investments serve the same function—some grow wealth, some generate cash flow, and others protect capital.

Financial success isn’t just about having a big portfolio—it’s about having the right mix of assets that serve your needs.

Asset category goals ensure your portfolio is designed to provide exactly what you need, when you need it.

Why This Comes Second:

Once your WHY is clear, you need to define what your portfolio must accomplish to support that vision.

This step prevents you from blindly chasing high returns without considering your liquidity needs, risk tolerance, and future goals.

Example: If your WHY is to leave your corporate job in 5 years, you may need 40% in income assets (cash flow) instead of keeping all your wealth in long-term growth stocks.

✔ HOW will I measure progress? (Performance Metrics)

Why It’s Important:

What gets measured gets managed. If you don’t define success upfront, you won’t know if your portfolio is actually working for you.

Performance metrics ensure your investments are delivering on their intended role—whether that’s growth, income, or stability.

Without clear benchmarks, you risk making emotional investment decisions based on short-term market swings instead of long-term strategy.

Why This Comes Third:

Once you define WHAT your financial outcomes need to be, you must establish clear, measurable targets to stay on track.

Having structured benchmarks ensures your strategy remains disciplined and allows for periodic course correction.

💡 Example: If you need $200K per year in passive income to sustain early retirement, your performance metrics should track whether your income-generating assets are meeting that goal.

✔ WHERE should I invest? (Asset Allocation Model)

Why It’s Important:

Asset allocation is the #1 driver of long-term investment success.

Even the best investments can fail if your overall portfolio structure is misaligned with your goals.

A well-structured allocation strategy ensures:

Diversification (reduces concentration risk)

Liquidity management (ensures access to capital when needed)

Tax efficiency (optimizes wealth retention)

Why This Comes Last:

You can’t make smart investment choices until you’ve defined:

WHY you’re building wealth

WHAT financial outcomes you need

HOW you’ll measure success

Skipping the previous steps leads to random investing—where you build a portfolio that may not actually serve your lifestyle and financial needs.

Example: If your WHY is financial independence, your portfolio allocation should prioritize income and liquidity, not just high-growth investments that lock up capital for decades.

Now It’s Your Turn to Architect Your Wealth

The biggest mistake investors make? Skipping the blueprint and jumping straight to investing. Without a solid foundation, your portfolio becomes reactive—filled with scattered decisions instead of a clear, structured plan.

But now you know the secret: The ultra-wealthy always start with architecture—designing their wealth with precision before they build.

At The WealthOps Way, we’ll take you through this exact process step by step.

You’ll:

✅ Define Your Legacy Statement – Get crystal clear on your WHY so every financial decision aligns with your long-term vision.

✅ Build Your Investment Thesis – Create a strategic roadmap that drives your portfolio forward with purpose.

✅ Architect Your Portfolio Plan – Structure your wealth like the ultra-wealthy, ensuring cash flow, scalability, and long-term security.

If you’re tired of second-guessing your financial future and want a proven blueprint to build lasting wealth, this is your moment.

Spaces are limited, and this event requires an application. Take control of your wealth today—your future self will thank you (LINK). 🚀

Managing Tech Millions is a Weekly Podcast that explores the process of building wealth through Tech Equity and managing the money that comes with it.

You can listen to our latest episodes:

If you prefer video, you can watch on our YouTube Channel

This is super useful! Thank you for sharing!