What a Running Micro Family Office Actually Looks Like

See what each of the 7 MiFO Components looks like when they're operational—not just documented

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

📋 What each of the 7 MiFO Components looks like when it’s running (not just documented)

🔄 The difference between “having a plan” and “operating a system”

🎯 One specific action you can take this week to move from Developing to Structured

Hey Portfolio CEOs,

Last week, you scored yourself on the 7 MiFO Components.

You identified your gaps. You saw where you’re reactive versus structured. You know your weakest component.

This week, I want to show you what those components look like when they’re actually running.

Not theory. Not “you should have this.” What it looks like in practice—in my MiFO, right now.

Because the difference between a portfolio and a business isn’t what you have. It’s what’s operational.

The time commitment? Roughly a couple hours per week. Plus one full day at the end of each month and two to three days at the end of each quarter for deeper reviews.

The goal? Reduce time spent on business operations. Focus time on wealth management—making investments, trading options, growing the top line. And strategic work to reduce the bottom line through tax optimization.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m showing you why retirement isn’t about how much you save—it’s about how you structure your wealth.

$3M vs. $10M: Why someone with $3 million can retire while others with $10 million are still working

Architecting Wealth: How ultra-wealthy families set up their wealth to work for them

The Four Key Systems: The strategies you need to build for true financial freedom

The Traditional Advice Trap: Why classic retirement advice doesn’t apply to high net worth individuals

Working Smarter, Not Harder: How to make your portfolio generate passive income and grow at the same time

What Is a Micro Family Office?

A Micro Family Office (MiFO) is a scaled-down version of what the ultra-wealthy ($100M+) use to manage their wealth—adapted for portfolios between $1M and $30M.

It’s not a portfolio you manage when you remember.

It’s a business built around your wealth—with systems, processes, infrastructure, and a team.

Most people have assets. You’re building architecture.

[Read the full breakdown here: What is a Micro Family Office?]

The Difference: Portfolio vs. Business

Component 1: Vision & Strategy (Running)

What it looks like:

My legacy statement sits in three places:

At the top of my Investment Policy Statement

On my annual review calendar (every January)

In a family meeting deck I share with my wife and sons

It’s not filed away. It’s active.

When someone pitches me a deal, I run it through my 30-Second Investment Decision Filter:

Which asset category? (Preservation / Income / Growth)

Does it meet my return targets? (3-4% / 6-10% / 10-15%)

Do I have room in my allocation? (Am I within 5% of target?)

Last year, a friend offered me access to a growth fund. Great pedigree. 15%+ target returns. Established operator.

Here’s how the filter worked:

Category: Growth

Returns: 15% (exceeds my 10-15% target ✓)

Allocation check: I’m already at 45% growth vs. my 40% target

Decision: Pass—overallocated.

My thesis prioritizes cash flow over speculation. I need 8%+ portfolio income to replace my paycheck. That fund generated capital gains, not income. I passed in 30 seconds. No FOMO. No negotiation.

That’s what running looks like: Decisions are obvious because the framework is operational.

Component 2: Portfolio Structure (Running)

What it looks like:

I have a three-tiered Income Ladder built for yield:

Base Layer (40%): Dividend aristocrats, blue-chip stocks—4-5% yield. Stable, recession-proof income.

Middle Layer (40%): REITs, PE real estate funds, preferred stocks—7-8% yield. More yield, moderate risk.

Top Layer (20%): Private credit, covered call ETFs, hard money lending—10-12% yield. Highest yield, least liquid.

Every quarter, I check allocation drift. If one layer grows beyond target, I rebalance.

My portfolio generated $180K+ in income last year. Not because I got lucky. Because the structure executes the strategy.

That’s what running looks like: The architecture operates independently. You adjust, not scramble.

Component 3: Legal & Tax Protection (Running)

What it looks like:

I have two entities:

Holding Company (The Vault): Owns real estate, investment accounts, intellectual property

Management Company (The Engine): Operates actively, executes Deduction Stack plays

Every month, my bookkeeper reconciles both entities. Every quarter, my CTP (Certified Tax Planner) and I review what tax plays we’re executing.

These are recurring plays I run annually:

Augusta Rule: Rent my home to my Management Company for 14 days ($7K deduction)

MERP (Medical Expense Reimbursement Plan): Reimburse medical expenses tax-free ($4,500 last year)

Family employment: Pay my sons for legitimate work in the business

I’m constantly moving up the Deduction Stack. I maintain the plays I’m already running and look for opportunities to add more. Each quarter, my CTP and I identify the next play to implement.

That’s what running looks like: Tax strategy isn’t reactive—it’s a systematized climb up the stack.

Component 4: Operations Process (Running)

What it looks like:

My bookkeeper reconciles my books every month. I don’t do the work—I review the dashboard.

I have a compliance calendar:

Monthly: Bookkeeping reconciliation, expense review

Quarterly: Tax planning meeting with CTP, portfolio review

Annually: Entity renewals, Operating Agreements review, legacy statement refresh

Every document lives in the same place. When my CPA asks for something, I send a link in 30 seconds.

Last year, I needed my Operating Agreement for a real estate investment. I pulled it up in 10 seconds. No searching. No “I think it’s on my desktop somewhere.”

That’s what running looks like: You’re not scrambling. The system runs you.

Component 5: Performance & Data (Running)

What it looks like:

I track seven KPIs every month:

By asset category:

Income category: Yield percentage + cash in the bank (actual dollars received)

Growth category: Growth amount (dollars gained) + state (am I in growth or drawdown?)

Capital preservation: Yield percentage (rolls into net worth)

Overall portfolio:

Expense coverage ratio (portfolio income ÷ lifestyle expenses)

Asset allocation drift (am I still executing my Investment Thesis?)

Tax efficiency (effective tax rate vs. target)

Investments in the red (what needs triage?)

I have a dashboard that updates automatically from all accounts. Review takes 15 minutes.

When portfolio income dipped below $15K one month, I saw it immediately. Adjusted allocation. Fixed it.

Most people check their brokerage account when they remember. I know my numbers cold because I track what matters.

That’s what running looks like: You measure what drives your goals, not just market returns.

Component 6: Team & Advisors (Running)

What it looks like:

My team includes:

Bookkeeper: Monthly reconciliation, expense tracking

CPA: Annual tax filing, quarterly check-ins

CTP (Certified Tax Planner): Proactive tax strategy, Deduction Stack execution

Estate attorney: Trust documents, succession planning

They coordinate with each other—not just with me.

Last quarter, my CTP emailed my bookkeeper directly to confirm a deduction. My bookkeeper sent the documentation. I got a summary. That’s it.

I’m the CEO. They’re the operators.

That’s what running looks like: Your team works together. You orchestrate, not micromanage.

Component 7: Executive Governance (Running)

What it looks like:

I have a decision-making framework I use for every investment opportunity:

The 30-Second Investment Filter:

Does it align with my legacy statement?

Does it fit my asset allocation model?

Does it generate cash flow or require speculation?

Do I understand the risk?

If I lose this money, does it impact my lifestyle?

If it fails any question, it’s a no.

I’ve used this filter to pass on deals worth millions. I’ve used it to say yes to opportunities I would have missed before.

My wife knows the framework. My oldest son is learning it. This isn’t just my decision system—it’s transferable.

That’s what running looks like: Decisions are systematic. Your family can operate using the same frameworks.

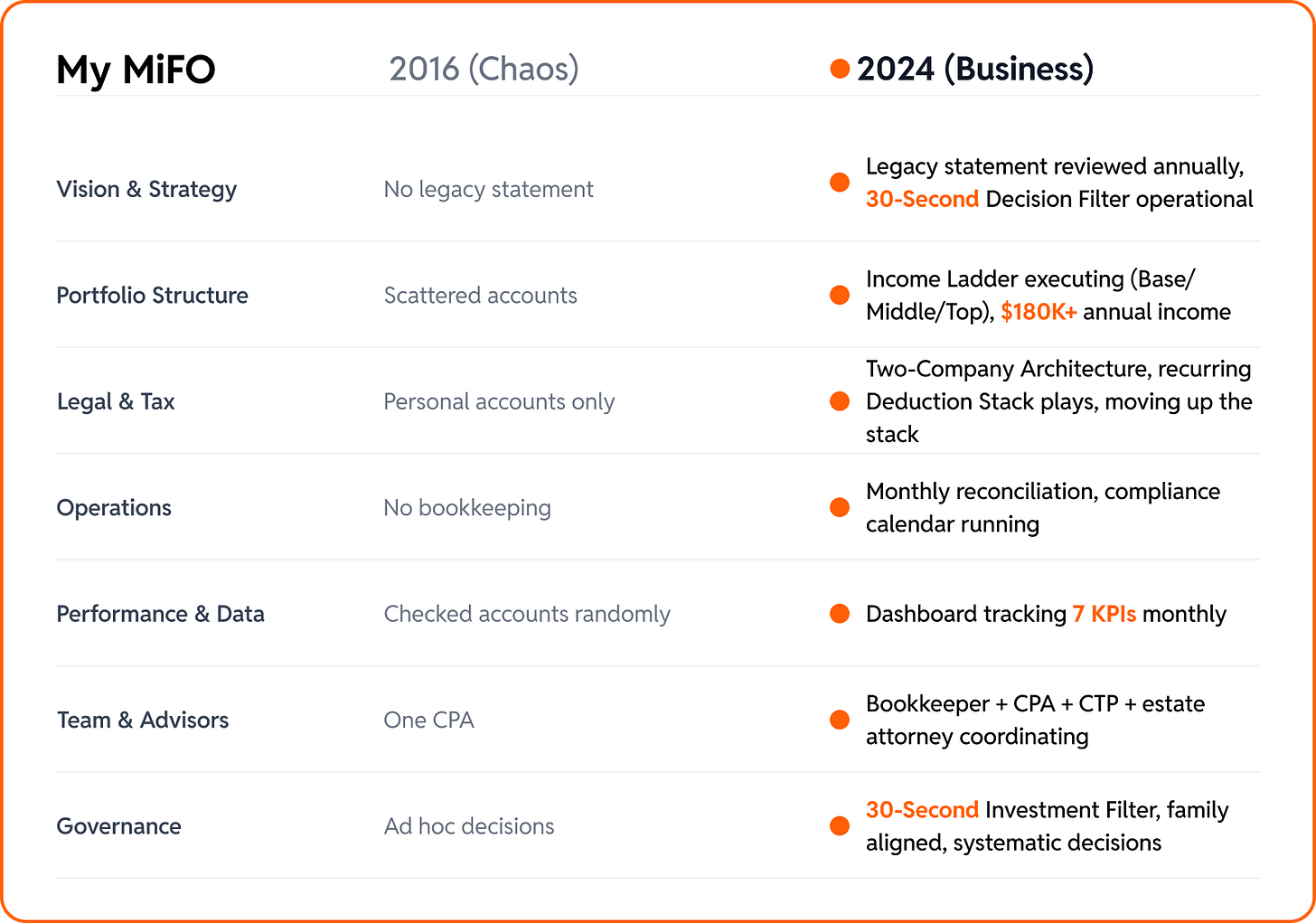

My MiFO in 2016 vs. My MiFO Today

The difference isn't what I have. It's what's running.

From Score to System

Last week, you scored yourself. You identified your gaps.

This week, you saw what running looks like.

Here’s the shift:

Score 0-1 (Reactive): You’re missing the component entirely. Pick ONE from this newsletter. Build it this month.

Score 2 (Developing): You have the document. Now operationalize it. Put it on a calendar. Share it with your team.

Score 3 (Structured): It’s running. Now optimize. Delegate one manual task.

Score 4 (Optimized): Teach it. Your family should be able to operate it without you.

Your Action This Week

Look at your lowest score from last week.

Pick one component from this newsletter.

Take one action to move it from document to operation:

Vision? Put your legacy statement at the top of your Investment Policy Statement. Share it with your spouse this week. Write your 30-Second Investment Decision Filter.

Portfolio Structure? Calculate how much portfolio income you generated last year. Build your Income Ladder (Base/Middle/Top) based on your targets.

Legal & Tax? Schedule a call with a CTP to review one recurring Deduction Stack play you’re not using yet.

Operations? Hire a bookkeeper. Get monthly reconciliation on a calendar.

Performance? Build a simple dashboard tracking your 7 KPIs. Start with income allocation, expense coverage ratio, and allocation drift.

Team? Schedule your first quarterly tax planning meeting with your CPA and CTP.

Governance? Document your 30-Second Investment Decision Filter. Use it on the next opportunity that comes your way.

One component. One action. This week.

That’s how portfolios become businesses.

—Christopher

P.S. In 2016, I had investments. In 2024, I have a business. The difference wasn’t more money. It was making the systems operational. Your score isn’t the goal. Running the system is.

Go Deeper

Ready to build all 7 components?

The MiFO Accelerator walks you through the complete system at your asset level—Builder, Operator, or Scaler path.

Subscribe to the newsletter: Get frameworks, systems, and practitioner insights every week → Managing Tech Millions

This is education, not advice. Learn the systems, don’t copy blindly.

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.