Why Do Ultra-Wealthy Families Allocate 28% to Private Equity?

While tech professionals earn 7-10% in traditional investments, families with $10M+ are capturing 15-25% returns through a completely different playbook

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

🧠 How to invest like a $10M+ family with smarter capital deployment

💵 How to generate consistent cash flow and unlock major tax benefits

📊 The two structures that can help you build wealth more strategically

Hey Portfolio CEOs,

I'm writing this from a café in Laxe, Spain, where I've been working remotely for the past month—not because I'm on vacation, but because my Micro Family Office generates the income that makes this lifestyle possible.

The freedom to work from anywhere is no longer just about remote jobs. It's about building a Micro Family Office that works whether you're in Silicon Valley or Southern Europe.

While most tech professionals are still trading time for money, the smartest ones are quietly building wealth systems that fund their ideal lifestyle. They understand that true freedom comes from assets that generate income, not just appreciation.

This week, I want to explore why private equity has become the cornerstone of every serious wealth-building strategy—and why ignoring it might be the most expensive mistake you're making.

The data is clear: while you're earning 7-10% in traditional investments, ultra-high-net-worth families are capturing 15-25% returns in private equity. More importantly, they're generating the cash flow that transforms wealth from a number on a screen into actual lifestyle design.

Building your Micro Family Office isn't just about growing wealth—it's about creating the infrastructure to live life on your terms.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, you'll learn how private investing works, and why it’s become the go-to strategy for the ultra wealthy.

Not Just for Billionaires: How new rules are unlocking access

The Return Advantage: What makes these investments perform differently

Smart Diversification: How private investing fits into a balanced strategy

What You’re Missing: Why tech professionals often overlook this path

Start with Clarity: A simple, clear framework to explore private deals

Here's a sobering reality check:

You've built an incredible tech career, possibly even blown past the magical $1M+ net worth milestone.

Your 401(k) is maxed out, your index funds are humming along at a respectable 8%, and you feel like you're doing everything right.

Meanwhile, ultra-high-net-worth families are playing a completely different game.

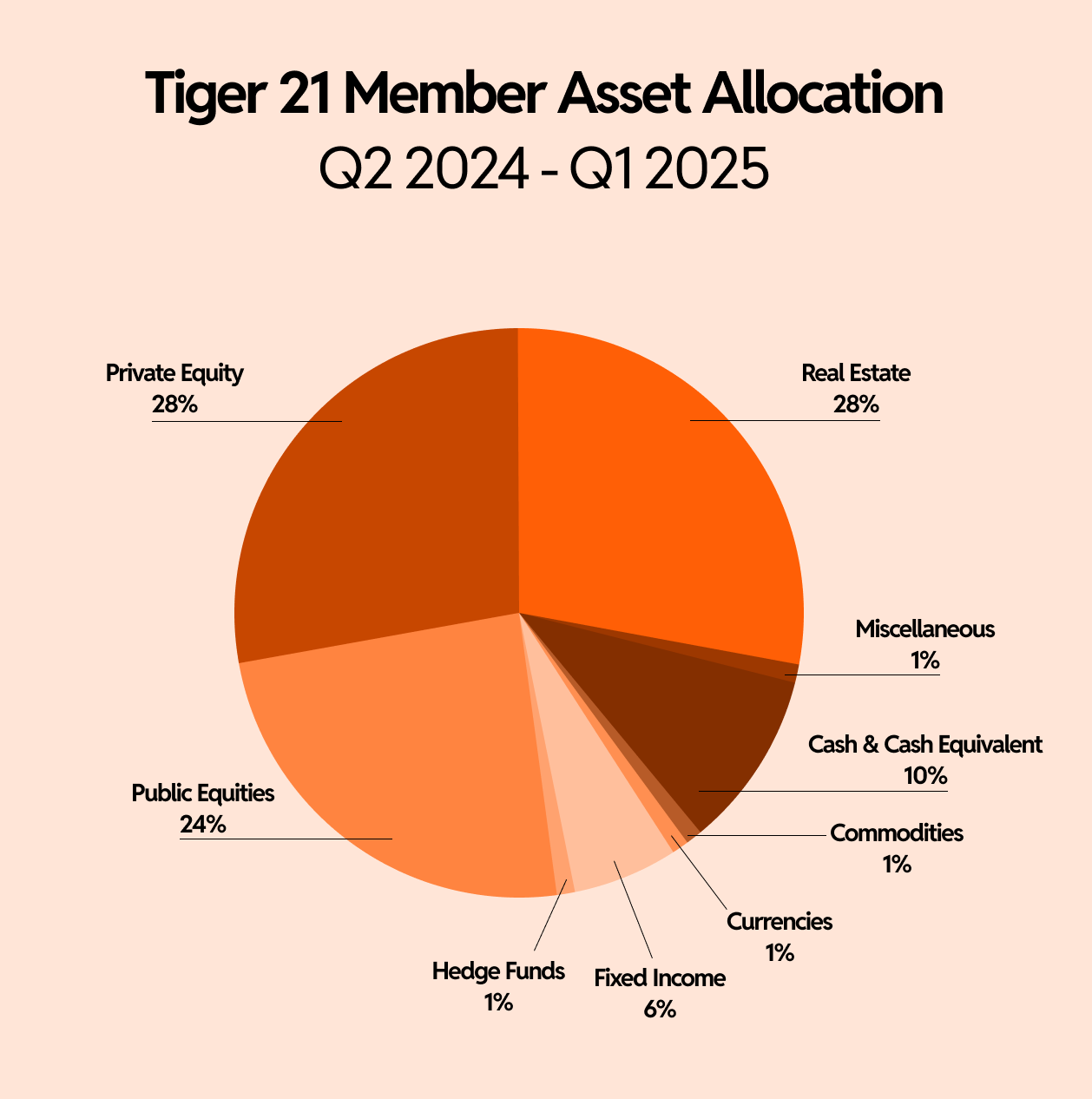

According to the latest TIGER 21 Asset Allocation Report—which tracks how individuals with $10M+ actually deploy their wealth—28% of their portfolios are allocated to private equity.

Not 3%.

Not 8%.

Twenty-eight percent.

Why does this matter for tech professionals building Micro Family Offices?

While you're competing for scraps in the public markets, these families are accessing an entirely different class of investments that have historically delivered superior returns with less correlation to market volatility.

The Private Equity Performance Gap Is Real (And Growing)

Let me share some numbers that might make your stomach drop. Over the past 20 years, private equity has consistently outperformed public markets:

Private equity average returns: 15-25% annually

S&P 500 average returns: 7-10% annually

The Pitchbook North American Private Equity Index: 18.8% over the past 5 years

S&P 500 over the same period: 9.9%

That's not a minor difference—it's a wealth-building chasm.

When I went through my first IPO in 2012, I made the classic tech professional mistake. I had multiple seven figures tied up in a single stock, riding the emotional rollercoaster of daily market swings. I was essentially playing Russian roulette with my financial future.

It took me over a decade of studying ultra-wealthy portfolio strategies to understand what I was missing.

Today, 50% of my portfolio is in private equity investments that generate income, effectively replacing my W-2 paycheck. That transformation didn't happen overnight—but it started with understanding why private equity deserves a seat at the table.

The Problem: You're Locked Out of the Best Investments

Here's the uncomfortable truth: traditional financial advisors aren't talking about private equity for three reasons:

First, they don't get paid to recommend it. Your advisor makes money managing assets under their umbrella. When you move capital into private investments, their revenue disappears.

Second, they often don't understand it themselves. Private equity operates outside the SEC's purview, which means it requires specialized knowledge that most advisors simply don't possess.

Third, regulatory changes only recently made these investments accessible. Before the JOBS Act of 2012, private equity was truly private—you couldn't even discuss investments without a 30-day "seasoning period." Now that advertising is permitted, you're seeing these opportunities everywhere, but most people still don't understand how to evaluate them.

The result?

You're stuck in the same investment paradigm as someone with $100K while having access to the same opportunities as someone with $10M.

Private equity isn't just about higher returns—though those are certainly attractive. It offers four distinct advantages that public markets simply can't match:

1. Cash Flow Generation

Unlike stocks that might pay a 2% dividend, many private equity investments provide monthly or quarterly distributions from operational profits. This is how you replace your paycheck and truly unlock lifestyle flexibility.

2. Asymmetric Returns

Experienced private equity operators have been executing in their specific markets for decades. Their deep expertise and established teams can generate outsized returns while actually reducing risk through knowledge and operational efficiency.

3. Tax Efficiency

Private equity investments, particularly in real estate, offer substantial depreciation benefits that can offset the income they generate. You could receive $100K in distributions while paying zero taxes due to depreciation offsets—and carry unused depreciation forward indefinitely.

4. Non-Correlated Assets

When public markets crater, private equity investments often maintain their value or continue generating income. This diversification isn't just theoretical—it's operational protection.

The Two Main Structures You Need to Understand

Private equity investments typically fall into two categories:

Syndications involve pooling investor capital around a single asset—think purchasing a specific apartment complex or commercial building. You have direct exposure to that asset's performance, for better or worse.

Funds aggregate multiple assets under professional management, providing broader diversification but potentially more complexity in understanding underlying performance drivers.

Both structures involve general partners (the operators) and limited partners (the investors). Your job is to understand the track record, fee structure, and operational expertise of the general partners before committing capital.

Why This Matters for Your Micro Family Office

When you're building a Micro Family Office, you're essentially creating a business around your wealth. Just like you wouldn't build a tech product using only one programming language, you shouldn't build wealth using only public market investments.

Ultra-high-net-worth families understand this intuitively. They allocate 28% to private equity and 28% to real estate because these assets provide:

Consistent cash flow to fund operations

Tax advantages that preserve wealth

Diversification that protects against market volatility

Professional management that scales beyond their personal time investment

The families represented in the TIGER 21 report didn't get wealthy by accident. They systematically deploy capital across asset classes that work in different market conditions, with private equity serving as a cornerstone of their wealth-building strategy.

The Bottom Line: It's About More Than Returns

Look, I get it. Private equity sounds complicated, risky, and exclusive. But here's what I've learned after transitioning my own portfolio: the biggest risk isn't investing in private equity—it's continuing to ignore it while inflation erodes your purchasing power and public market volatility destroys your peace of mind.

The ultra-wealthy aren't smarter than you. They just have access to better investment structures and the knowledge to use them effectively.

Ready to dive deeper into how private equity actually works and why it's become essential for tech professionals building serious wealth?

I break down the entire private equity landscape—including specific examples, risk factors, and due diligence frameworks—in my latest podcast episode.

You'll learn exactly how to evaluate opportunities, understand fee structures, and avoid the common pitfalls that trap inexperienced investors.

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.

PE has severely underperformed in the last 4 years and is bogged down by a huge pipe of companies that don't have liquidity. It is a different think to look at Vista and Benchmark and different to average PE fund.