👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

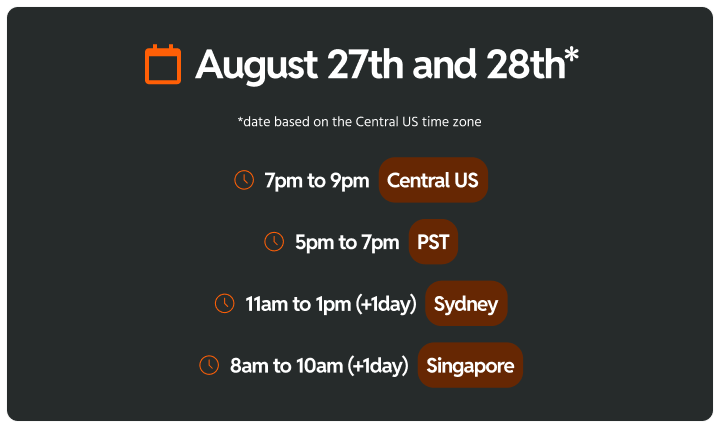

When? 📆 August 27th and 28th at 7pm to 9pm (Central US)

Despite building a $7M cash-flowing portfolio and going through three tech IPOs, none of it prepared me for the realization that I might be raising kids who would destroy it all.

Living in Silicon Hills—Austin’s tech bubble—my three sons were growing up in luxury, worried more about iPad batteries than anything real. Like many high-earning parents, I thought I was doing enough: financial literacy apps, savings accounts, investment talks. But I realized I was actually creating entitled kids, not financially responsible ones.

That’s when everything changed.

Instead of taking a $15,000 vacation to Disneyland, my wife and I made a controversial choice: we flew our kids to Uganda. Not for fun. For service. That trip shattered their worldview—and mine.

They met kids their age walking miles for clean water, missing school to help their families survive. For the first time, my boys saw that money isn’t just for spending—it’s a tool that can solve real problems and transform lives.

That one decision led to a massive shift in how we parent, how we give, and how we build our legacy.

I call it the Four Pillars of Wealth Responsibility:

Global Perspective – Regular exposure to how the rest of the world lives, works, and overcomes challenges.

Impact Investing Mindset – Treating giving like investing, with outcomes, metrics, and accountability.

Problem-Solving Development – Training kids to see challenges as opportunities to create solutions.

Intentional Legacy Building – Teaching that inheritance isn’t just money—it’s responsibility and mission.

These shifts didn’t come from lectures or apps. They came from lived experiences—service trips, real conversations, and mindset changes. And the best part? You don’t need to fly overseas to start this journey.

From local food banks to community projects, there are ways to help your kids break the entitlement cycle and see wealth as something to grow and share—not just consume.

This approach not only transformed our family—it’s reshaping how I advise other high-net-worth families through WealthOps. When your kids start asking, “How much impact could this create?” instead of “How much does this cost?”, you know you're building a legacy that will last.

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company.

If you like the podcast, support us by letting us know what you think (one click); please do that now!

Loading...

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Start up-leveling your knowledge - 🎧️ Follow our Podcast

Get our detailed How To Videos- 📺️ Subscribe to our Channel

Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps Way

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.