👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

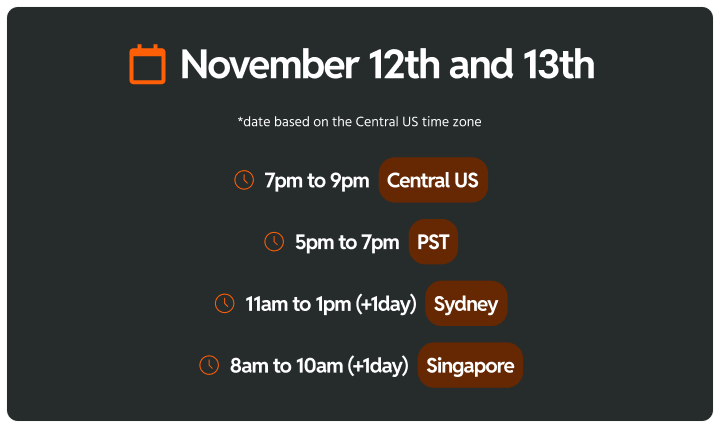

When? 📆 November 12th and 13th at 7pm to 9pm (Central US)

If you think hitting $1 million means you’re financially free, think again. That might’ve been true in 1980, but today? That barely puts you in the top 10% of net worth in America—and it’s not enough to stop working.

In todays episode, I break down the exact net worth thresholds for the top 10%, 5%, and 1% in the U.S.—both total net worth and investable net worth. I’ll also share where I personally stand, how wealth strategies evolve at each level, and what it really takes to break into the top 1%.

Using fresh data from the Federal Reserve’s 2022 Survey of Consumer Finances, we’ll walk through how wealth changes—not just in amount, but in structure.

You’ll see why the climb from median net worth to the top 10% is steep, but getting from 10% to 1% is an exponential leap.

And here’s the big insight: the difference between owning assets and owning capital.

Most people in the top 10% are “house-rich,” but not capital-rich. Nearly 60% of their wealth is tied up in a primary residence that doesn’t generate income. Meanwhile, in the top 1%, nearly half of net worth comes from private business equity—not real estate or stocks.

We’ll also unpack what I call The Great Decoupling—the moment the truly wealthy shift their wealth strategy entirely. It’s not about more assets—it’s about different kinds of assets, systems, and mindset.

If you’re a high earner or successful professional feeling stuck—even with a $2M+ portfolio—this is your wake-up call. You may already be in the top 10%, or even top 5%, but if you’re still using the wrong wealth management playbook, you’ll never break into the top 1%.

Whether you’re just starting to think about investable net worth, or already building legacy-level wealth, this video is your roadmap for moving from income dependence to true financial independence—and eventually, to becoming the CEO of your wealth.

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company.

If you like the podcast, support us by letting us know what you think (one click); please do that now!

Loading...

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Start up-leveling your knowledge - 🎧️ Follow our Podcast

Get our detailed How To Videos- 📺️ Subscribe to our Channel

Accelerate your actions, attend a Master Class (its Free) 🧠 The WealthOps Way

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.