How to Think Like a Family Office CEO (Not a Nest Egg Builder)

The difference between making millions and managing millions (spoiler: it's everything)

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

💼 How to shift from managing your wealth reactively to architecting it intentionally

🧠 The 5 mindsets that separate the ultra-wealthy from the rest of us

🌐 How to apply institutional strategies to your personal wealth management

Hey Portfolio CEOs,

The numbers should excite and terrify you in equal measure.

Since 2019, America has minted 2.25 million new millionaires. Tech is creating more wealth than ever before – we're projected to hit 25 million millionaires by year's end. The explosion is real, and if you're reading this, you're probably part of it.

But here's the gut punch that nobody talks about at your company all-hands: Most tech millionaires are being set up to fail.

Not because they can't code. Not because they can't scale products.

But because they're making three catastrophic mistakes that guarantee their wealth won't last:

Managing like the middle class – Using strategies designed for $100K earners, not $10M builders

Treating portfolios like savings accounts – Park money and pray

Following trends instead of systems – Speculating instead of strategically investing

Sound familiar? That programming runs deep.

After my IPO in 2012 left me with 90% of my wealth in a single stock, I spent 12 years studying how ultra-wealthy families actually operate. Not the Instagram version. The real systems behind closed doors.

What I discovered changed everything.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m revealing how to escape the financial dead zone and manage your wealth like a billionaire—without the $100M price tag.

The Financial Dead Zone: Why the wealth management system is leaving you stuck

Micro Family Office: How to operate like the ultra-wealthy with a $1M–$30M net worth

WealthOps Framework: The 3 phases to go from amateur to sophisticated wealth manager

Maximize Control, Minimize Costs: How I cut $200,000 in fees by building my own system

Scalable Growth: Why your wealth can grow smarter and faster with this framework

The 5 Principles That Separate Wealth Builders from Wealth Preservers

Principle 1: Your Portfolio Is a Legacy Business, Not a Nest Egg

Middle Class Mindset: "I'm building retirement savings for myself. Maybe leave something for the kids."

Ultra-Wealthy Mindset: "I'm building a business to impact multiple generations and causes I care about."

See the difference?

The ultra-wealthy don't build static pools of money.

They build evergreen portfolios designed to:

Protect principal

Generate income to live on

Grow appreciating assets

Run systematically like a business

Train the next generation as operators

They document this with two critical components I now use myself:

Legacy Statement – Your wealth's purpose and intended impact

Portfolio Thesis – Asset allocation strategy aligned with multi-generational goals

This isn't about money. It's about aligning your wealth to your purpose.

Principle 2: You're the CEO, Not an Employee of Your Wealth

Remember that feeling when you became a tech director? The shift from individual contributor to leader?

Most tech millionaires never make that same shift with their wealth.

Traditional model: You're at the bottom, financial advisor at the top, hoping for results while focusing on making more money.

Ultra-wealthy model: You're the CEO with specialists reporting to you:

Set vision and strategy

Hire/fire your financial team

Direct resources like a business

Own the outcomes completely

Would you let someone else run your product team? Then why let someone else run your wealth?

Principle 3: The Alternative Asset Revolution

Pull up your Fidelity account. I'll wait.

Let me guess – 70% stocks, 20% bonds, 10% cash? Maybe some crypto because you're "diversified"?

Here's what my portfolio looked like at IPO:

90% Splunk stock

10% Checking account

100% Anxiety

Here's what it looks like today (UHNW allocation):

30% Private Equity

25% Real Estate

20% Public Equities

12% Cash & Equivalents

8% Fixed Income

5% Alternatives

The shift? Income AND growth. Multiple uncorrelated income streams. True diversification that weathers any storm.

Principle 4: Specialists Scale, DIY Dies

That "do everything myself" mentality that got you promoted? It's killing your wealth potential.

DIY Approach:

You do everything

Focus on cost, not value

Limited by your hours

Rigid, slow, prone to mistakes

Ultra-Wealthy Approach:

Specialists bring expertise

Innovation from diverse perspectives

Built to scale beyond you

Systems create redundancy

My wealth team now includes:

Tax strategist (saved me $400K last year)

Estate attorney (protecting generational transfer)

Private equity advisor (deal flow access)

Bookkeeper (accurate real-time reporting)

ROI on this team? 10x minimum. The innovation and opportunities they bring? Priceless.

Principle 5: Run It Like a Business or It Runs You

Here's the brutal truth: If your money isn't working extremely hard for you, you're working extremely hard for your money.

Middle-Class Management:

Check quarterly statements

React to market drops

Hope tax person figures it out

Mixed with personal finances

My Portfolio Business Operations:

Monthly KPI reviews

Quarterly strategy sessions

Annual deep-dive assessments

Separate LLC structure

Deductible business expenses

Clear performance targets

Every Monday at 9am, I run a portfolio operations meeting. Just like your sprint planning, but for wealth.

The Ultimate Goal: Your Money Working Harder Than You Ever Did

These five principles aren't just strategies – they're your blueprint to flip the entire equation.

Right now, you're still the primary wealth generator in your family. Every morning, you wake up, open that laptop, and trade your time for money.

Sure, it's good money – maybe great money – but you're still the machine.

The ultra-wealthy understand a fundamental truth: The goal isn't to make more money. It's to make your money make money.

When you implement these five principles, something profound happens.

Your portfolio transforms from a static pile of RSUs into a wealth-generating machine that runs 24/7. Your money starts working nights and weekends while you don't. Y

our assets begin producing income while you're at your kid's soccer game.

This is the real transition from money maker to money manager – from being the product to being the CEO.

I made this shift after my IPO. Instead of grinding harder to earn the next million, I architected systems that generated the next millions for me.

My private equity investments now throw off monthly distributions. My real estate pays me while I sleep. My portfolio businesses run without my daily input.

The result? I replaced my tech salary with portfolio income. Now I work because I want to, not because I have to.

That's the lifestyle unlock these principles create. Not retirement – but choice. Not passive income – but actively managed wealth that's passive for you.

The question isn't whether you want this freedom. Of course you do.

The question is whether you're ready to stop being your family's income engine and start building the machine that runs without you.

The Fork in Your Road

Right now, you have two paths:

Path A: The Comfortable Decline

Keep doing what you're doing

Watch inflation erode your wealth

Hope your equity compensation keeps coming

Pray the next crash doesn't wipe you out

Path B: The Portfolio CEO Transformation

Architect your financial fortress

Build systems that scale

Create multiple income streams

Design the life you actually want

The choice seems obvious. But here's why most won't take Path B: It requires admitting what got you here won't get you there.

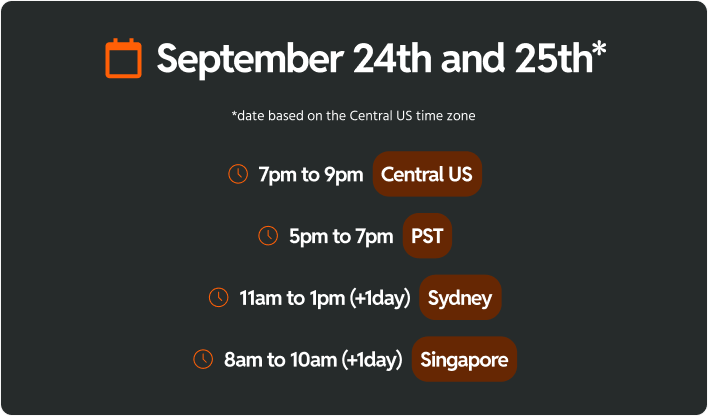

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.