The $2M Question: Can Your Micro Family Office Fill the Corporate Void?

The silence after leaving corporate (and how to fill it)

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn how to:

🚀 Step off autopilot and architect your wealth intentionally.

🎯 Choose a Portfolio Personality that matches your desired lifestyle.

📊 Run your Micro Family Office efficiently with minimal hours and maximum impact.

Hey Portfolio CEOs,

The Question That Keeps Coming Up

Last week alone, three different executives reached out with variations of the same question:

"Christopher, I think I have enough to leave corporate... but what the hell am I going to do with myself?"

Sound familiar?

You've hit your financial independence number. Your equity compensation has paid off. You could theoretically walk away tomorrow.

But there's this nagging voice asking: What happens in the silence?

That moment when you don't have sprint planning, quarterly reviews, or the constant hum of Slack notifications. When the corporate machine that's defined your identity for the past decade suddenly... stops.

I get it. I've been there.

I chose to walk away at what was the height of my corporate career to manage my Micro Family Office and spend less time on my resume and more time on my family legacy. One of the hardest things I ever did.

But here's what nobody tells you - I was confident that what I was going to do next would fill me up more than corporate ever could.

Why? Because I would be working on a personal mission, not someone else's.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m revealing the legal tax strategies billionaires use—and how you can apply them to save six figures a year.

Billionaire Tactics, Real Results: How Trump, Bezos, Musk and others pay $0 in taxes legally

Buy, Borrow, Die: How to tap portfolio value without triggering taxable events

Depreciation and Deductions: How real estate and smart structuring lower your tax bill

From 35% to 15%: How my clients are cutting their tax rates—without breaking the law

WealthOps in Action: A step-by-step plan to start managing taxes like the ultra-rich

The Identity Crisis No One Talks About

Here's what most financial independence content won't tell you: The hardest part isn't accumulating the wealth—it's figuring out who you are without the corporate structure that's been running your life.

Tech professionals are builders. We're problem-solvers. We thrive on complex systems and measurable outcomes.

Remove that framework, and many of us feel... lost.

"I have $6M in assets, but I wake up every morning wondering what I'm supposed to do with my life." — Former Google engineering director

The FIRE movement sells you on the dream of "never working again." But let's be real - you didn't become successful by sitting on beaches sipping mai tais.

You became successful by building, creating, and solving problems.

What if the answer isn't to stop working, but to start working on something that actually matters to you?

Your Micro Family Office: More Than Just Money Management

Here's what I've discovered working with many tech professionals and executives who've made this transition:

Your Micro Family Office can give you a purpose and vision that's larger than your corporate job ever did.

Think about it:

Instead of optimizing someone else's quarterly metrics, you're building something generational

Instead of shipping features that might get deprecated next quarter, you're architecting wealth that will impact your family for decades

Instead of attending meetings about meetings, you're making strategic decisions that directly impact your freedom

Your Micro Family Office becomes the ultimate startup—with you as the CEO, CTO, and product manager all rolled into one.

But here's the kicker: Unlike a startup, you're not hoping for product-market fit. You already have it.

The product is your wealth. The market is your life. And the metrics? They're whatever you decide matters most.

Choose Your Own Adventure: The Portfolio That Fits Your Personality

One of the most powerful aspects of running your own Micro Family Office? You get to choose exactly how active or passive you want to be.

After my hundreds of meetings with tech professionals, I've identified three distinct "Portfolio Personalities":

The Hands-On Builder 🔨

Maybe you want to spend time doing deep due diligence on limited partner deals, managing rental properties, or sitting on startup boards. Your portfolio becomes your laboratory.

Example: Former Lyft engineer now flips houses in Austin while running a systematic options strategy that generates $30K/month

The Strategic Investor 📊

Perhaps you prefer systematic stock strategies, index fund optimization, or building a diversified income-generating machine that largely runs itself.

Example: Ex-Amazon director automated 90% of portfolio management, spends 4 hours/week on strategic decisions

The Hybrid Operator 🎯

Most of my clients end up here—80% systematic income generation, 20% active investments that scratch that entrepreneurial itch.

Example: Ex Splunk PM runs core portfolio on autopilot, actively angel invests in 5-10 startups yearly

The beauty? You control the dial. Feel like being more active this quarter? Dial it up. Want to spend six months traveling? Dial it down.

This isn't possible in corporate. But with your Micro Family Office, you're the boss.

The Systems That Set You Free

When you structure your Micro Family Office with proper systems and processes—what we call the WealthOps framework—something magical happens.

Your business operations get handled efficiently, freeing you to focus on high-leverage decisions and the lifestyle you actually want.

It becomes what corporate promised but never delivered: Work that energizes you, on your terms, building something that matters.

Here's what this looks like in practice:

Monthly: 2-hour portfolio review and rebalancing

Quarterly: Half-day strategic planning session

Annually: Full portfolio audit and strategy refresh

That's it.

Maybe 100 hours per year of focused work that directly impacts your wealth and legacy and more if you want to. Your choice!

Compare that to the 2,000+ hours you're currently giving to someone else's mission.

The Bottom Line

Can your Micro Family Office fill the void left by corporate?

Absolutely.

But only if you approach it like the business it is—with systems, strategy, and clear objectives.

The silence after leaving corporate isn't empty space to be feared. It's open canvas waiting for you to architect something extraordinary.

Ready to start building your own Micro Family Office?

Here's your next step: Block 2 hours this week to write down what your ideal "Portfolio CEO" life looks like.

Not the money—the actual day-to-day. What are you building? Who are you helping? What legacy are you creating?

Then ask yourself: Is staying in corporate getting you closer to that vision, or further away?

Stay systematic / Christopher

P.S. If this resonates, I'm curious: What's your biggest fear about leaving the corporate structure? Hit reply and let me know.

Every response helps me create better content for this community, and I personally read every single one.

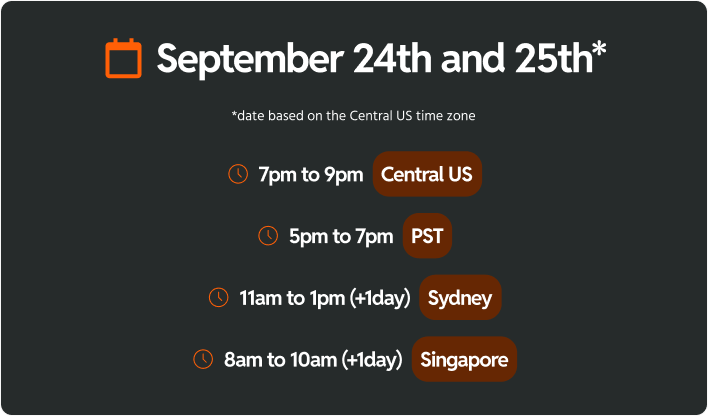

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.