The 3 Skills that Separate Lucky Investors from Wealthy Ones

From money maker to wealth manager: the skills that matter

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

📈 What actually makes someone a great investor

⚖️ Why smart sizing protects you in volatile markets

🧘 How disciplined patience drives long-term compounding

Hey Portfolio CEOs,

August might be the last days of summer, but it's become my favorite time for tax strategy work.

While everyone else is focused on back-to-school and last weekend’s away, I'm deep in the weeds building strategies to continue lowering my effective tax rate.

Here's what I've learned after years of managing tech wealth:

Tax strategy isn't something you bolt on at year-end. It's foundation work that needs to be built into your micro family office from day one.

The difference is staggering. When you architect tax efficiency into your wealth systems, you're not just saving money – you're supercharging your compounding for decades to come.

I'll be sharing more of what I'm discovering during our August deep dive at the live WealthOps Way event on September 20th and 21st in Austin. Hit reply if you want to know more.

But before we get to September's intensive work, I want to address something many tech professionals have been asking me lately...

There's a fundamental question that keeps coming up in my conversations with portfolio CEOs.

It came up again in three separate calls just this week, and I realize it's something we need to tackle head-on.

The question is always some variation of: "What actually makes someone a great investor versus just a lucky one?"

After 12+ years of managing my own portfolio and countless conversations with tech professionals making this transition, I've identified three core skills that create the separation... 👇

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m sharing the moment I realized I wasn’t just building wealth—I was raising kids who could destroy it. And what I did to change that.

The Wake-Up Call: Why a $15K vacation turned into a life-changing trip to Uganda

Breaking the Entitlement Cycle: How lived experience reshaped our family’s values

The Four Pillars: A framework to raise financially responsible kids with global awareness

From Consumption to Contribution: How my sons learned to see money as a tool for impact

Legacy That Lasts: How this shift is transforming not just my family—but how I advise others through WealthOps

The 3 Skills That Separate Lucky Investors from Wealthy Ones

Why patience beats intelligence in wealth building

Here's a question that's been nagging at me: What's the real difference between someone who gets lucky in the markets and someone who builds generational wealth?

After 12+ years managing my own portfolio and having deep conversations with hundreds of tech professionals, I've cracked the code. It comes down to three specific skills that separate the amateurs from the pros.

But here's what most people miss: these aren't concepts you learn once and forget. They're skills – like coding languages. You don't learn Python once and call yourself a developer. You practice, debug, iterate, and improve over years.

Let me break down the three that matter most:

Skill #1: Valuation – Your Investment North Star

Whether you're evaluating private equity deals, public stocks, or venture opportunities, valuation is everything.

Here's the harsh truth: You make money when you buy, not when you sell.

If you can't accurately assess what something is worth, you're flying blind.

Are you buying at a premium? Fair value? Or did you find a diamond in the rough?

I learned this lesson the most expensive way possible. During my first IPO, 90% of my wealth was tied to a single stock. My valuation method? "It's going up."

That emotional rollercoaster taught me that understanding intrinsic value isn't optional – it's a matter of survival.

The more you understand an asset's true value, the clearer every investment decision becomes.

Skill #2: Allocation Sizing – Your Portfolio's Immune System

This is where I see even sophisticated investors stumble in our one-on-one conversations.

Never let any single position dominate your portfolio. Period.

Whether we're talking about your macro portfolio or smaller specialized allocations, the magic happens between 3-10% position sizes.

Think of allocation sizing as your portfolio's immune system.

It's what keeps you alive during market downturns and choppy conditions. The research consistently backs this up – proper allocation sizing is your key to portfolio safety during volatile periods.

I've watched brilliant tech executives lose millions because they couldn't resist going "all in" on what felt like a sure thing. The market has a way of humbling even the smartest people.

Skill #3: Patience – The Wealth Builder's Secret Weapon

Here's the uncomfortable truth: Patience separates wealth builders from wealth destroyers.

Too many people let emotions rule reason. They chase trends, panic during corrections, or convince themselves "this time is different."

Sound familiar?

But patience isn't passive waiting – it's active discipline.

It's the confidence to say, "I'm not worried about missing out because I know there will always be opportunities."

It's recognizing when market conditions aren't right and having the discipline to wait for the right moment.

Savvy investors are incredibly patient with the market. They understand that the best opportunities come to those who can wait for the right conditions.

Your Action Plan This Week:

Audit your valuation skills – Can you confidently assess the value of your current holdings?

Review your allocation sizes – Are any positions over 10% of your portfolio?

Practice patience – What investment decision are you rushing that could benefit from more time?

Remember, these skills compound over time. The tech professional who masters valuation, allocation sizing, and patience today becomes the portfolio CEO who builds generational wealth tomorrow.

These three skills aren't just investment principles. They're the foundation of running your wealth like a business.

Keep building!

Best / Christopher

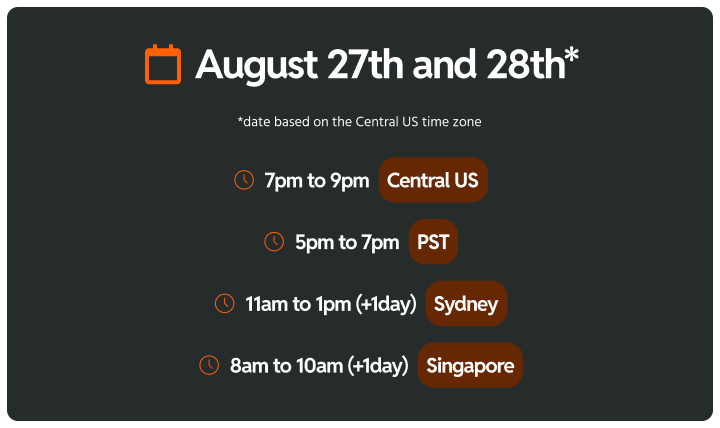

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.