The 5 Problems a Micro Family Office Solves

Why tech professionals are ditching traditional wealth management

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

🚫 Why spreadsheets and guesswork don’t scale with seven-figure wealth

💼 How a Micro Family Office creates structure, clarity, and control

📉 What’s costing you time, money, and peace of mind—and how to fix it

Hey Portfolio CEOs,

There's a moment that every successful tech professional faces—and most of us don't talk about it openly.

You're staring at your portfolio dashboard at 11 PM, watching your net worth fluctuate by more than most people's annual salary. The RSUs that made you feel wealthy six months ago now feel like a ticking time bomb. Your financial advisor keeps pitching the same cookie-cutter strategies they sell to every high earner.

That sinking realization hits: you've mastered building scalable systems at work, but your personal wealth management is completely broken.

I had this exact moment 5 years ago. Despite multiple successful exits and what looked like financial success from the outside, I was managing millions like a complete amateur. Scattered spreadsheets. Reactive decisions.

Zero systematic approach to the thing that mattered most—my family's financial future.

The truth that no one prepared us for: making money and managing wealth are completely different skill sets.

It's like being a brilliant software architect and assuming you can automatically run DevOps. Same domain, entirely different challenges.

Today, I want to walk you through the five critical problems that keep tech professionals stuck in wealth management amateur hour, and why more of us are building our own Micro Family Offices to solve them systematically.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m sharing the strategy that helped me build $6 million in net worth—not through salary, but through equity.

Salary ≠ Wealth: Why chasing income kept me stuck

The Power of Equity: How stock grants and refreshes changed everything

Real People, Real Results: Why Jessica ended up $1M ahead by playing a different game

Your Hidden Advantage: How engineers, PMs, and tech pros can unlock this wealth lever

Equity Over Paychecks: How to negotiate, compound, and finally get ahead

Problem #1: Managing Wealth Without Clear Goals

Here's the uncomfortable truth: Most tech professionals manage their wealth reactively without any roadmap for long-term success.

You know the drill: get home late, eat food, try to be social, and look for a place to lie down. It's so hard to know where even to start with your wealth!

We're brilliant at architecting complex systems at work, but when it comes to our portfolios? We wing it. Market goes up, we feel smart. Market tanks, we panic. RSUs vest, we let them sit. No clear direction, no measurable objectives.

The data is clear: According to a study by Dominican University, people who wrote down their goals, shared them with others, and maintained accountability were 33% more successful in achieving them than those who merely formulated goals in their heads.

Think about it—you wouldn't build software without requirements and success metrics.

Why manage millions without the same clarity?

Here's what changes with goal-driven wealth management: Every decision you make, from divesting to reinvesting, aligns with specific objectives. With this clarity, your portfolio becomes a tool for achieving your life's vision, not just a collection of assets.

WealthOps introduces a top-down framework rooted in your legacy statement and values, aligning your most significant goals and purpose to your financial outcomes.

When you have crystal-clear targets, wealth management transforms from overwhelming to systematic.

Problem #2: The Equity Concentration Time Bomb

Let's talk about the elephant in the room: concentrated stock positions.

If you're like most tech professionals, 70-90% of your net worth is tied to your company's stock. When the market smiled on us, this felt genius. When it didn't... well, you know how that story goes.

The data is sobering: Employees holding more than 20% of their net worth in company stock face significant unnecessary risk. Proper diversification can reduce this risk by up to 50%.

I learned this lesson personally during my first IPO. Watching my net worth swing $100K+ daily based on one stock's performance was exhausting. More importantly, there was a solution I wasn’t aware of.

Here's what most people miss: Diversification isn't just about reducing risk—it's about optimizing returns. Research shows a well-diversified portfolio can potentially increase returns by 15.09% compared to single-goal strategies.

The solution isn't to dump all your equity overnight (hello, tax implications). It's to develop a systematic divestiture strategy that:

Minimizes tax impact through strategic timing

Redeploys capital into income-producing assets

Reduces portfolio volatility while maintaining growth potential

Think of it as refactoring your portfolio—same core value, better architecture.

Problem #3: Lack of Systems for Managing Wealth

Managing wealth without structure is overwhelming, error-prone, and drains your time.

This isn't talked about enough, but it's a huge motivation killer. People don't know where to get started or how to learn the skill of wealth management. Just some simple templates and direction would help enormously.

Here's the shocking reality: We spend months architecting software systems that handle thousands of transactions per second, then manage million-dollar portfolios using scattered spreadsheets and gut feelings.

The cost of this amateur approach is massive. A study by Vanguard found that implementing a systematic approach to wealth management—what they call "Advisor's Alpha"—can potentially add about 3% in net returns annually.

This systematic approach includes proper asset allocation, rebalancing, tax-efficient strategies, and behavioral coaching.

Meanwhile, research from Charles Schwab shows that 65% of individuals with written financial plans feel financially stable, compared to only 40% of those without plans.

What systematic wealth management actually means: With WealthOps, you implement processes that standardize up to 80% of routine financial tasks. You also learn how to build out a team to take key operational tasks off your plate.

This frees you to focus on the high-impact 20% that drives real portfolio growth and income. Think of it as running your portfolio like a business—with efficiency and precision at every step, not reactive chaos.

Problem #4: Inefficient Tax Strategies

Poor tax planning chips away at your wealth, leaving significant savings unrealized.

I'm shocked at how many people I speak with who are dissatisfied with their tax professionals. This service provider—which is hard to find but incredibly valuable—can save you hundreds of thousands of dollars over your career.

Yet most of us treat tax planning like debugging—something we deal with when problems arise, rather than architecting solutions proactively.

The numbers are staggering: Research indicates that tax-efficient investing strategies can potentially save investors up to 2% in annual returns. Over time, this significantly impacts wealth accumulation. A separate Vanguard study found that tax-efficient strategies could add up to 0.75% of additional return annually.

Think about that compounded over a 20-year period—we're talking hundreds of thousands in additional wealth.

Strategic tax efficiency goes beyond April 15th: WealthOps integrates tax-efficient strategies throughout the entire framework.

From divesting assets to optimizing investments, every move is designed to preserve more of your hard-earned money.

This isn't about aggressive tax schemes—it's about systematic coordination of timing, structure, and strategy to help you grow your portfolio faster and more effectively.

Problem #5: Lack of Financial Confidence and Education

Even the most skilled tech professionals can feel unprepared and overwhelmed when managing their wealth.

I get it—getting your head around a different discipline is hard. However, it's not as hard as much of your daily work as a tech professional.

The issue is that financial education isn't taught in computer science programs, and most traditional financial advice doesn't address the unique challenges of equity compensation and tech careers.

Here's the costly reality: A National Financial Educators Council survey found that 28% of respondents reported that lack of financial knowledge cost them over $10,000 in their lifetime. This number can be much higher for tech employees earning hundreds of thousands annually.

But here's the encouraging news: Research shows that individuals with basic understanding of financial concepts are more confident, happier, and more likely to achieve their financial goals.

What changes when you develop financial confidence?

Decision-making becomes strategic rather than reactive

You can evaluate opportunities and risks independently

Market volatility becomes manageable rather than stressful

You attract better financial partners and advisors

WealthOps simplifies complex financial concepts into actionable, bite-sized steps. With hands-on tools, educational resources, and community support, you'll build the confidence and mastery to manage your wealth like a seasoned professional.

Think of it like learning a new programming language—intimidating at first, but once you understand the fundamentals, you can build increasingly sophisticated solutions.

These five problems aren't just individual challenges—they're symptoms of a broken approach to wealth management.

That's exactly why I built WealthOps as a systematic solution that addresses each issue through integrated processes and frameworks.

The WealthOps Transformation

Before implementing systematic wealth management:

Overwhelmed and disorganized → Scattered tools, reactive decisions

High-risk, single-asset exposure → 70-90% concentrated in company stock

Uncertain decision-making → Emotional responses to market movements

After implementing WealthOps principles:

Strategic and systematic → Clear processes and regular optimization

Diversified and resilient → Risk-adjusted portfolio generating income

Confident and proactive → CEO mindset applied to wealth management

The question isn't whether this transformation is possible—it's whether you're ready to make it happen.

Your Next Move

Look, I get it. Transitioning from money maker to wealth manager feels like learning to scale from startup to enterprise—overwhelming at first, but absolutely critical for long-term success.

The good news? You don't have to figure this out alone.

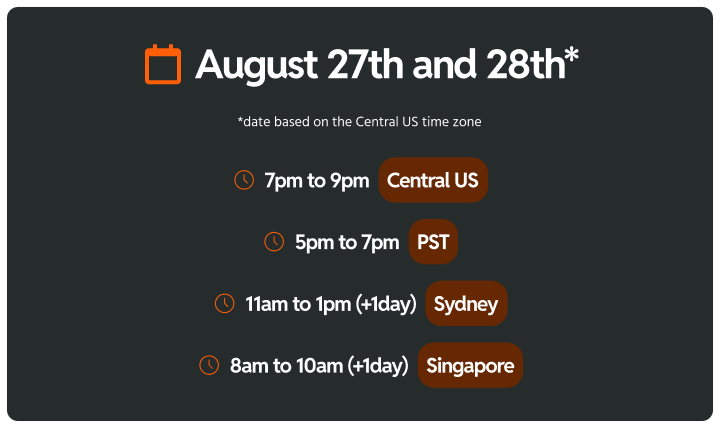

I'm hosting the WealthOps Way in August—a comprehensive system that transforms how tech professionals build and manage wealth.

Think of it as your framework for transitioning from high earner to sophisticated wealth manager.

This isn't another generic financial course. It's specifically designed for our unique challenges: equity compensation optimization, systematic portfolio management, and building scalable wealth systems.

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.