The Definitive Guide to Micro Family Offices

Everything You Need to Know About Modern Wealth Management for $1M-$30M Net Worth

What Is a Micro Family Office™?

If you work in tech or business, you've probably heard the term “family office” tossed around — maybe in a YouTube video or by a friend who just sold their startup.

But unless you're already deep into wealth planning, the concept might still feel a little fuzzy.

Here’s why this matters: if you’re a tech professional holding $1M+ in equity or liquidity, the micro family office may be the single most powerful tool you’re not using to build generational wealth and take full control of your financial future.

A micro family office™ is the modern evolution of the traditional family office — leaner, tech-powered, and tailor-made for entrepreneurs and professionals who want to manage their wealth like a business. It combines the strategic advantages of high-end financial structures with the flexibility and efficiency required for today’s fast-moving world.

In this article, you will learn:

What are family offices

What are the origins of family offices

What defines a micro family office™

How a micro family office™ differs from traditional family offices

When and how to start a micro family office™

Let’s begin by defining exactly what a family office is — and why it's suddenly everywhere.

What Is a Family Office?

A family office is a private, centralized business built to manage a family’s wealth across generations.

At its core, it’s a personal financial team that handles everything related to a family’s money, assets, and even lifestyle logistics.

Family offices are designed to preserve, grow, and transfer wealth efficiently and securely.

They typically manage investments, coordinate tax and estate planning, handle bill payments, oversee legal matters, and may even assist with personal services like travel or property management.

These offices come in many shapes and sizes—from lean operations supporting families with $1–10 million in assets, to fully staffed enterprises managing billions.

Common functions of a family office include:

Investment management and asset allocation

Tax strategy and compliance

Estate and succession planning

Risk management and insurance oversight

Philanthropy, trusts, and charitable giving

Family governance and financial education

Before we dive into the modern micro family office, let’s take a look at where the original concept came from—and why it’s evolved.

When Did Family Offices Start?

The History and Evolution of Family Offices

The idea of a family office isn't new—it dates back centuries to when wealthy families needed trusted stewards to manage their estates.

As early as the 6th century, European nobility relied on major-domos, who served as centralized managers of land, wealth, and household operations. During the Medieval period, this role evolved into structured systems using trusts (fideicommissum) to preserve generational wealth and land ownership.

The Birth of the Modern Family Office: 19th Century

The modern family office emerged during the Industrial Revolution, as newly wealthy industrialists needed more sophisticated ways to manage large fortunes.

In 1838, the Morgan family created the House of Morgan to manage their growing assets.

In 1882, John D. Rockefeller established what is widely considered the first true single-family office (SFO)—a full-service structure that included investment oversight, philanthropy, and succession planning.

These early family offices moved beyond banks, hiring dedicated experts to create custom wealth strategies and set the foundation for today’s models.

Global Growth and Institutionalization: 20th Century to Today

Family offices spread globally in the 20th century, fueled by industrial wealth, globalization, and later, tech innovation. By the 1980s, single-family offices were common among ultra-high-net-worth families, typically requiring $100M+ in assets to justify the cost.

Key inflection points that drove growth:

Dot-com boom: Created a wave of new wealth requiring customized solutions

2008 financial crisis: Families sought greater control, privacy, and risk management

Technology: Enabled leaner structures and global investment reach

Today, there are an estimated 6,000 to 10,000 SFOs globally, managing over $6 trillion in assets. Their services now include everything from tax optimization and estate planning to direct investments and philanthropy.

Current State of Family Offices

Family offices are no longer quiet background players—they’re becoming one of the most powerful forces in global finance.

Today, family offices collectively manage an estimated $10 trillion in assets, surpassing the $6.5 trillion managed by hedge funds. That staggering figure reflects a major shift: private wealth is outpacing institutional capital in both scale and influence.

We’re also entering an unprecedented era of wealth transfer. Over the next two decades, more than $124 trillion in global wealth is expected to transition to the next generation. This monumental shift puts family offices—especially modern, agile ones—at the center of long-term financial strategy for high-net-worth individuals.

What’s more, this isn’t an old-money model.

68% of all family offices were established after 2000

50% have been created since the 2008 financial crisis

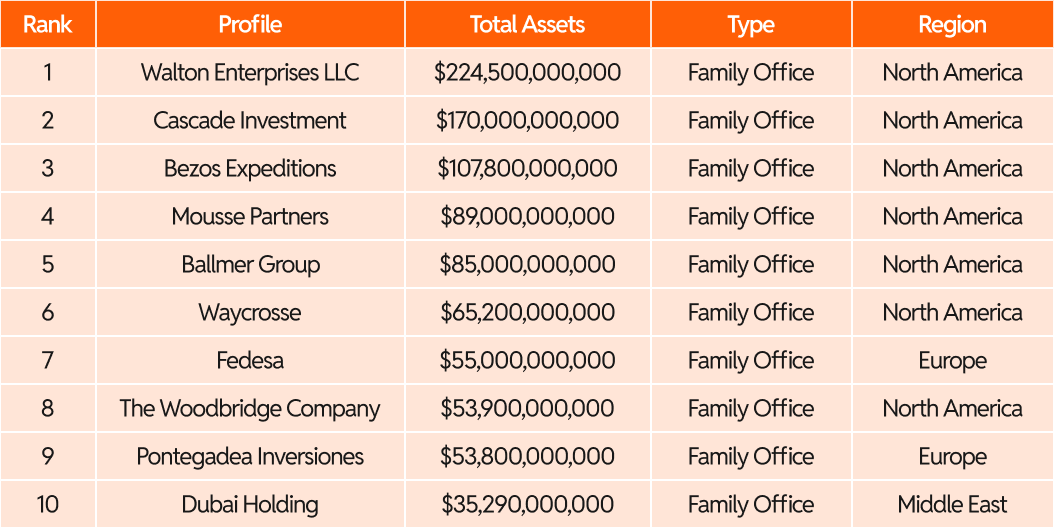

Largest Single Family Offices in 2025

This explosive growth reflects a rising distrust in Wall Street and a desire for customized, transparent wealth management.

Today’s family offices are built with broader investment mandates, direct access to deals, and a strong emphasis on aligning financial strategy with family values.

Types of Family Offices

There are three main types of family offices, typically distinguished by the size of assets under management (AUM) and how services are delivered.

1. Single Family Office (SFO)

A Single Family Office is a dedicated structure that serves just one ultra-wealthy family.

Minimum AUM: $100 million+

Typical annual costs: $1–2 million

Cost efficiency: ~1–2% of AUM

At this level, families can afford full-time staff, advisors, and infrastructure to manage complex wealth strategies, succession planning, and family governance.

2. Multi-Family Office (MFO)

A Multi-Family Office shares resources across multiple wealthy families to reduce costs.

Ideal starting net worth: $30 million+

Typical fees: $300,000–$1 million per year

Cost efficiency: ~0.5–1% of AUM

MFOs are appealing for families that want high-touch service but don't have the scale to justify a fully in-house SFO.

3. Micro Family Office™ (MiFO)

The Micro Family Office is a lean, efficient model designed for high-earning individuals or families with $1M–$30M in assets.

Ideal for: Tech professionals, startup founders, and solo entrepreneurs

Structure: Uses outsourced or fractional advisors, tech platforms, and standardized playbooks (WealthOps)

Goal: Run your wealth like a business—not a side hustle

MiFOs bring the benefits of a traditional family office—control, strategy, and structure—without the overhead, making them an emerging solution for modern wealth creators.

The Service Desert and the Emergence of the Micro Family Office™

Rapid Growth at the Top… and the Bottom

Over the last two decades, the number of family offices has exploded—50% of the ~10,000 single family offices in existence today were established after 2009. Much of this growth has been concentrated at the top of the wealth pyramid, among families with $100M+ in assets.

But something equally powerful has been happening at the base.

In 2023 alone, the U.S. added over 500,000 new millionaires, representing a 7.3% increase in the millionaire population. And this isn’t slowing down: by 2028, the number of U.S. millionaires is projected to grow by another 16%, reaching 25.4 million individuals.

Technology Equity as a Wealth Engine

A massive portion of this wealth creation is being driven by the tech sector—especially through equity compensation. While comprehensive industry data is limited, company-specific cases show just how much value is being unlocked through stock-based compensation.

RSUs (Restricted Stock Units) have overtaken traditional stock options as the go-to form of equity compensation for late-stage and public tech companies.

Within the next decade, publicly traded companies are expected to issue nearly $800 billion in RSUs to employees. (LINK)

In 2025 alone, Tech Companies are projected to pay employees over $40 Billion in RSUs (LINK)

This flood of newly liquid wealth is creating a new kind of millionaire—one with complexity, ambition, and investment needs that traditional financial advisors aren’t designed to serve.

The Service Desert

Here’s the disconnect: families with $1M to $30M in net worth—especially in tech—want family office-level service:

Access to private equity, real estate, direct investments, and advanced tax planning

Strategic frameworks for wealth preservation, income generation, and legacy building

But traditional wealth managers often lump these clients in with mass-affluent households, offering cookie-cutter portfolios and basic advice. Worse, when these clients express interest in private investments or alternative strategies, they’re often discouraged from pursuing them.

Frustration Created Innovation

That mismatch created a vacuum—and the Micro Family Office™ (MiFO) stepped in to fill it.

Over the last decade, a growing number of high-earning individuals and newly wealthy families have begun building their own lean, tech-powered family offices. These setups are customized, cost-efficient, and structured to make their wealth run like a business—not an afterthought.

This is more than a trend. It’s a quiet revolution reshaping wealth management from the bottom up.

The Rise of the Micro Family Office™

From DIY Wealth Management to a New Model

Since the early 2000s, more millionaires—especially in tech—have struck out on their own to build personalized wealth structures. These were often inspired by the idea of a family office but operated more like customized private wealth management firms.

While these DIY setups offered direct access to private equity, real estate, and tax-efficient investing, they lacked the full architecture and strategic structure that defines a true family office. Many were focused solely on portfolio management—missing the integrated approach that supports generational wealth.

Taking a Single Family Office and Making It Micro

The idea of the Micro Family Office™ emerged through the research of Christopher Nelson, who sought to understand how elite Single Family Offices (SFOs) function from end to end. His goal: distill that model into a scalable system for professionals with $1M to $30M in net worth.

Unlike the ad-hoc DIY model, the Micro Family Office™ approach begins with architecture: mission, planning, structure, and intent.

Building a full SFO—often taking 12–18 months—was condensed into a focused, 4-month system designed for busy executives and entrepreneurs.

What Makes a Micro Family Office Unique

A Micro Family Office™ (MiFO) combines the strategic depth of a traditional family office with the efficiency of modern tools and flexible, fractional service models. It’s optimized for people who want to manage their wealth like a real business—not just react to their portfolio.

Every MiFO is built using the WealthOps framework, which distills the most essential functions of a Single Family Office into a streamlined, executable model.

Key Features of a Micro Family Office™:

Efficiency-Driven: Standardized processes and digital systems reduce overhead and friction

Pay-as-You-Go: Hire specialists only when needed—no full-time team required

Scalable Design: Structured to grow from 7-figure to 8-figure+ portfolios

Future-Ready: Evolves into a shared or full family office as complexity increases

How Micro Family Offices™ Work

A Micro Family Office™ (MiFO) functions like a lean, purpose-built financial business. It is designed to give you the control and customization of a Single Family Office without the cost or complexity.

Unlike large family offices that require full-time teams and millions in overhead, a Micro Family Office uses fractional advisors, outsourced experts, and smart systems to create a focused, strategic wealth engine.

Key Operating Principles

Lean Team Structure: You don’t need in-house staff. Instead, you use vetted external professionals—CPAs, attorneys, RIAs—on a project or retainer basis.

Technology-Enabled: Your tech stack replaces headcount. Tools for accounting, reporting, communication, and document management keep your operation efficient.

Founder-Led Oversight: As the principal, you remain the chief decision-maker. The MiFO is designed for active professionals who want visibility without micromanagement.

Standard Operating Framework: Instead of reinventing the wheel, you apply the WealthOps system—so you always know what to do next, and why.

What Makes It Work?

The strength of the Micro Family Office™ is in its system design. You’re not relying on ad hoc advice or generic wealth management products. You’re following a structured approach built around:

Clear investment strategy

Strong legal foundation

Defined workflows and responsibilities

Integrated reporting and communication tools

Aligned external partners

Whether you're allocating to private equity, managing concentrated stock, or planning generational transfers, your MiFO is set up to run with clarity, consistency, and speed.

Core Functions of a Micro Family Office™

Though lean in structure, a Micro Family Office™ mirrors the core disciplines of a traditional family office.

Here’s what’s included:

1. Wealth Management

Strategic investing, portfolio design, cash flow optimization, and legacy alignment

→ Build an investment plan aligned with long-term goals, divest intentionally, and maintain healthy liquidity.

2. Business Operations

Bookkeeping, accounting, tax strategy, legal compliance, and admin systems

→ Run your financial life like a business—with clear systems, repeatable processes, and tax-smart execution.

3. Technology & Workflow

System design, automation, cybersecurity, and documentation management

→ Use a tech stack designed to simplify operations while protecting sensitive financial data.

4. Partner Selection & Management

Advisor sourcing, performance oversight, accountability, and reporting

→ Build a high-performance team of professionals—and manage them like business partners, not vendors.

5. Family Governance, Education & Succession

Mission development, legacy planning, and next-generation empowerment

→ Define your family’s purpose, educate heirs, and create a seamless wealth transition plan.

6. Lifestyle Design & Concierge Services

Philanthropy, travel, estate oversight, and life experience planning

→ Align wealth with life—whether that’s global adventures, charitable impact, or simplified daily living.

Micro Family Office™ vs. Traditional Family Office Models

There are now three primary types of family office structures as we learned earlier, each designed for different levels of net worth, complexity, and desired control. Here's how they compare:

Key Differences at a Glance

Which Model Fits You Best?

Single Family Office (SFO): Best for ultra-high-net-worth families ($100M+) with complex generational planning needs and a desire for full-time staff and total in-house control.

Multi-Family Office (MFO): A strong fit for families in the $30M–$100M range who want access to curated services, investment opportunities, and experienced advisors—without the cost of a full SFO.

Micro Family Office™ (MiFO): Ideal for emerging millionaires ($1M–$30M), especially those in tech or entrepreneurship, who want to manage wealth like a business using modern systems, fractional experts, and a scalable strategy.

Benefits of a Micro Family Office™

A Micro Family Office™ (MiFO) offers more than just a leaner version of a traditional model—it delivers control, customization, and cost-efficiency for those who want to manage their wealth with purpose, without unnecessary complexity.

Here are the key advantages:

1. Full Control Without Full-Time Overhead

You remain the decision-maker. The MiFO is designed for founders, tech professionals, and executives who want high-level strategy with a fractional team—not a staff payroll.

2. Institutional-Grade Strategy for Emerging Wealth

You get access to the same disciplines used by ultra-wealthy families: structured investing, tax planning, asset protection, and succession—all scaled to your life and assets.

3. Cost Efficiency That Grows With You

Traditional SFOs can cost $1M+ per year. A Micro Family Office™ typically operates at a fraction of that, often between $25K and $250K annually, with clear ROI from smarter decisions, tax savings, and risk reduction.

4. Technology-First Approach

You leverage digital tools to replace personnel—streamlining operations, improving transparency, and securing sensitive data without complexity.

5. Alignment With Your Life and Goals

Your MiFO is structured to serve you—your mission, your timeline, your family. It enables wealth to support your lifestyle, rather than dominate it.

6. Future-Ready and Scalable

Start lean. Scale as your net worth grows. The MiFO can evolve into a shared family office or even a full SFO over time—with your architecture already in place.

The Micro Family Office™ isn’t about downsizing—it’s about right-sizing. It gives modern wealth creators the tools and clarity to grow and protect their wealth with intention.

When Does It Make Sense to Start a Micro Family Office™?

Who It’s For—and When to Make the Move

The Micro Family Office is not for everyone, but for a rising class of high-earning professionals, liquid tech equity holders, and DIY investors hitting complexity, it’s the natural next step.

Here’s how to know when you’re ready—and if this model is right for you.

You Should Consider a Micro Family Office™ If:

Your net worth is between $1M and $30M

You're past the mass-affluent stage, and traditional wealth advisors aren’t meeting your needs.You've recently had a liquidity event

Selling a business, exercising stock options, or receiving an inheritance creates complexity that demands structure.You're ready to go beyond DIY investing

Spreadsheets, scattered tools, and disconnected advisors worked before—but now you're looking for strategic, streamlined execution.You're building an investing business

If you view your portfolio as an engine for financial freedom and legacy—not just a passive nest egg—this structure gives you the control and systems to operate like a pro.You want to be the CEO of your wealth

You don’t want someone else driving the strategy. You want to make the calls, stay informed, and run your capital with purpose.You're scaling time and impact—not just returns

A Micro Family Office lets you reduce mental overhead, delegate operational noise, and focus on high-leverage decisions that align with your values.

If you’ve outgrown mass-market financial advice and want a professional-grade system tailored to your assets, mindset, and goals—this is your moment.

Steps to Create a Micro Family Office™

The WealthOps Framework: Architect → Build → Run

While the Micro Family Office covers a lot of ground, building and operating one doesn't have to be overwhelming. The WealthOps framework breaks it down into three clear, actionable phases that can be executed part-time over just a few months.

1. Architect

Set your foundation with purpose and precision.

This is where you define your wealth philosophy and vision—before you ever pick an investment.

Clarify your values, mission, and long-term legacy goals

Develop your Investment Thesis (asset classes, risk tolerance, liquidity targets)

Decide what success looks like beyond just returns

Design your org chart: Who's involved, who makes decisions, and how

2. Build

Structure your legal, financial, and operational systems.

This phase takes the strategy and turns it into infrastructure.

Set up legal entities (LLCs, trusts, etc.)

Formalize banking, accounting, and reporting structures

Create workflows for investment tracking, cash flow, and compliance

Choose your tech stack and onboard fractional advisors

3. Run

Operate with discipline—without being consumed by day-to-day admin.

This is where your Micro Family Office becomes your strategic financial engine.

Maintain regular reviews and performance dashboards

Oversee your external team using clear roles and KPIs

Stay focused on high-leverage decisions: asset allocation, taxes, philanthropy, and legacy

Adjust systems as your wealth and complexity evolve

With WealthOps, you’re not just managing money—you’re designing a repeatable, scalable system to run your wealth like a business and secure your future with intention.

Real-World Examples of Micro Family Offices™

Voices From the Field

The best way to understand the Micro Family Office model is to hear from those who are actually using it.

In the episodes below, you'll meet individuals and families who’ve transitioned from scattered investments and ad-hoc planning to a structured, strategic approach using the WealthOps framework.

🎙️ Podcast: Why I Chose to Build a Micro Family Office Post-IPO

Learn how a tech executive used his liquidity event to build a lean, scalable system for managing his investments and creating family alignment.

🎙️ Podcast: From Money Maker to Money Manager with David Banks

The exec who turned his portfolio into a business and walked away from corporate.

These stories illustrate the flexibility, power, and real-world application of the MiFO approach—showing that it’s not just theory, but a practical tool for next-gen wealth builders.

A Smarter Way to Build Wealth

The traditional family office model isn’t broken—it’s just not built for everyone. The Micro Family Office changes that, offering a modern, scalable, and strategic path for those who want to run their wealth like a business.

Here’s what you’ve learned:

What defines a Micro Family Office™ and how it differs from traditional structures

Why this model is rising in response to tech-driven wealth and outdated service models

How to create your own MiFO using the WealthOps framework: Architect → Build → Run

If you’re serious about moving beyond scattered spreadsheets, salesy advisors, and investment guesswork—this is your next move.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

Frequently Asked Questions

What is a Micro Family Office™?

A Micro Family Office™ (MiFO) is a lean, technology-enabled wealth management structure designed for individuals or families with $1M–$30M in assets. It mirrors the core functions of a traditional family office—like investing, tax planning, and legacy design—but uses a streamlined, fractional model with no full-time staff required.

How is a Micro Family Office™ different from a Single or Multi-Family Office?

Single Family Offices (SFOs) serve one ultra-wealthy family and require $100M+

Multi-Family Offices (MFOs) serve multiple families and often require $30M+

Micro Family Offices™ (MiFOs) are optimized for net worths between $1M–$30M and use systems, tech, and outsourced experts to stay lean and efficient

Who should consider starting a Micro Family Office™?

Tech professionals with equity compensation

Founders post-exit

Entrepreneurs and investors managing $1M–$30M

DIY investors seeking structure and scale

Families planning for legacy, control, and high-leverage impact

What services does a Micro Family Office™ typically include?

Investment strategy and portfolio management

Tax planning and legal structuring

Bookkeeping, compliance, and reporting

Estate and succession planning

Lifestyle design, philanthropy, and family education

How much does it cost to run a Micro Family Office™?

Most Micro Family Offices operate between $25K and $250K per year, depending on complexity and service needs. Costs are often project-based or fractional, not salaried.

What is the WealthOps framework?

WealthOps is a proprietary operating system for Micro Family Offices. It includes three phases—Architect, Build, and Run—designed to help you launch a structured, scalable family office in just 4 months, part-time.

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.