The Real Reason You Hate Looking at Your Portfolio

And the simple flip that transforms anxiety into excitement

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

⚙️ How to flip your portfolio from chaos to clarity

🎯 Why a clear Legacy Statement and Investment Thesis are key

💡 How transforming your approach eliminates decision fatigue

Hey Portfolio CEOs,

It was incredible meeting so many of you at our last WealthOps Way live event last week.

The energy in that room was something else. There's nothing quite like being surrounded by peers who actually get it – people who understand the unique challenges of managing tech wealth.

The relief on people's faces when they realized they weren't alone in their struggles was palpable.

One conversation particularly stuck with me. A director from a FAANG company in our feedback said, "I've been to dozens of financial seminars, but this is the first time I don't feel like the weird one for having these problems."

That's exactly why we do these events. To create a space where we can have real conversations about the challenges we all share but rarely discuss openly.

(Speaking of which – we're hosting our next live event in Austin this September. If you want to join us for two days of transformational wealth management work with your peers, hit reply and I'll send you the details.)

But here's what really struck me from our session last week...

There's a moment that happens in every WealthOps Way when someone asks a question that reveals an uncomfortable truth.

Last week was no different.

Someone asked me, "Christopher, how often do you check your portfolio?"

"Almost every day," I replied without thinking.

The room got quiet. Then someone said, "Yeah... not that often for me."

That's when I realized – they weren't asking to learn my habits. They were looking for permission to admit their own avoidance.

So I turned it around and asked the group: "How often do you all actually check yours?" The floodgates opened. Nervous laughter. Sheepish grins.

One person admitted they hadn't logged into their brokerage account in three months. Another said they "peek" maybe once a week but quickly close the tab if things look messy.

And that's when it hit me...

Most of us are managing our wealth completely upside down.

And that backwards approach is exactly why you're avoiding your portfolio like it's a messy garage you keep promising to clean.

Let me show you what I mean...

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m revealing how to generate over $250,000 in income from a $3 million portfolio—without selling assets and paying minimal taxes.

Beyond Growth: Why traditional financial advice isn’t enough for the middle wealthy

The Evergreen Income Framework: How asset operation beats the outdated growth and drawdown model

Smart Assets: Why private equity, credit, and energy infrastructure are your keys to strong returns

Tax-Free Wealth: How to use tax strategies to reduce your tax rate to as low as 3–5%

Building Like the Ultra-Wealthy: How to create a micro family office for reliable income and long-term growth

The Upside-Down Portfolio (And Why You Avoid Looking at Yours)

Sound familiar?

If you're nodding your head right now, you're not alone. This pattern of portfolio avoidance isn't about laziness or lack of caring. It's a symptom of something much deeper.

Here's the truth: You're managing your wealth completely backwards.

And until you flip your approach right-side up, you'll keep experiencing that same dread every time you think about logging into your accounts.

The Backwards Way (That's Causing Your Pain)

The typical approach looks like this:

Step 1: Jump straight into investments

"What stocks should I buy? Should I get into crypto? Is real estate better than index funds?"

Step 2: Maybe think about strategy later

"I guess I should have some sort of plan..."

Step 3: Infrastructure? What infrastructure?

"I'll figure out the bookkeeping at tax time..."

No wonder you don't want to look at your portfolio. It's like trying to drive a car you assembled in the wrong order – wheels on the roof, engine in the trunk, steering wheel in the back seat.

You've created an untended garden. Weeds everywhere. No clear paths. Things growing in random directions. Of course, you're overwhelmed with decision fatigue. Of course, you don't want to look at it.

The Right-Side-Up Approach (That Changes Everything)

After 12 years of transforming my own tech wealth from chaos to clarity, here's what actually works:

1. Strategy FIRST (Not Last)

Before you buy a single investment, you need two foundational documents:

Your Legacy Statement: This defines your "why." What's the purpose behind your wealth? What do you want it to achieve beyond just "more money"?

Your Investment Thesis: This is your strategic playbook. Based on your goals, risk tolerance, and timeline, how will you invest? What are your rules? What are your boundaries?

Think of this like defining your system architecture before writing code. You wouldn't start coding without knowing what you're building, right?

2. Infrastructure SECOND (The Foundation Nobody Talks About)

Here's the unsexy truth that will transform your wealth: Bookkeeping is the foundation of a great portfolio.

I know, I know. Bookkeeping sounds about as exciting as documentation. But hear me out.

Without proper bookkeeping:

Your taxes become a nightmare (and you overpay)

You can't track real performance

You have no idea what's actually working

Every decision feels like a guess

When you have clean books and solid systems, suddenly you have a dashboard for your wealth. You know exactly where you stand, where you're going, and how to get there.

3. Investments LAST (Yes, Really)

Only AFTER you have a strategy and infrastructure do you start making investment decisions. But here's the beautiful thing – when you have the first two in place, investment decisions become obvious.

Your strategy tells you what to buy.

Your infrastructure tells you when and how much.

Your investments just execute the plan.

The Transformation: From Avoidance to Engagement

When you flip your approach right-side up, something magical happens.

Instead of an untended garden that fills you with dread, you have a well-designed landscape that you actually want to spend time in. You've got clear paths, everything has its place, and you know exactly what needs attention and when.

People who've made this flip tell me they went from checking their portfolio once a quarter (with anxiety) to engaging with it weekly (with excitement).

Why?

Because now they're working IN their wealth management business, not hiding from it.

Your Next Move

Here's your homework for this week – just pick ONE:

Option A: Draft Your Legacy Statement

Take 15 minutes. Write one page answering: "What is the purpose of my wealth beyond just accumulation?"

Option B: Audit Your Bookkeeping

When did you last reconcile your accounts? Do you know your exact net worth right now? If not, that's your starting point.

Option C: Stop Making New Investments

Until you have strategy and infrastructure in place, put a pause on new investment decisions. I know it's hard, but trust the process.

The point isn't perfection. The point is flipping your approach right-side up so you can finally build wealth with confidence instead of anxiety.

Remember: You're not building a portfolio. You're building a wealth management business. And every successful business starts with strategy and systems, not products.

Ready to flip your approach?

Hit reply and tell me which option you're tackling this week. I read every response.

To your wealth transformation / Christopher Nelson

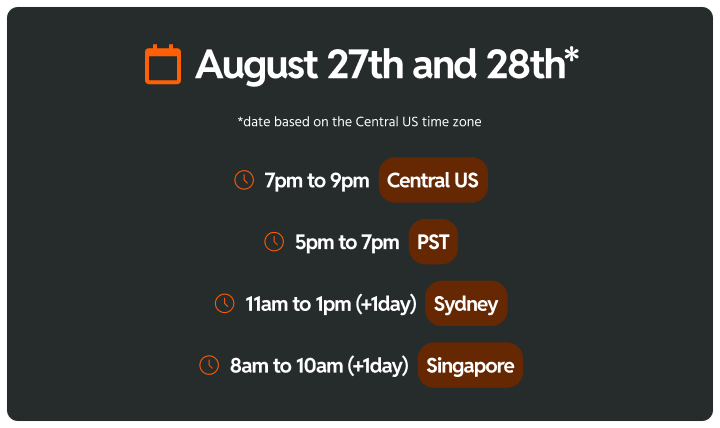

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.