Why First-Generation Wealth Builders Struggle (and How to Break Free)

Breaking societal norms to build generational wealth on your terms

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

🏗️ The 7 principles that separate portfolio CEOs from passive investors

🧠 How to apply your career skills to building generational wealth

📐 The operational frameworks behind serious long-term wealth

Hey Portfolio CEOs,

We're in the middle of our August WealthOps Way course, and I'm watching something powerful unfold.

People are drafting their first legacy statements. Giving their wealth actual purpose.

And what always excites me most is how many want to be the CEO and leader of their wealth.

But here's what I've learned after years in this space: This desire runs headfirst into massive resistance.

We have societal norms telling us not to talk about money (thanks, parents).

We struggle against a financial industry that wants total control—relegating us to glorified bookkeepers of our own wealth.

The system is designed to keep you dependent, not independent.

Most wealth managers profit more when you stay confused than when you gain clarity.

But there's a way to break free from this cycle, and it starts with understanding how real portfolio CEOs think differently.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m sharing how I cut over $200K in annual wealth management fees—and built a micro family office that gives me full control without the $100M price tag.

The Big Lie: Why most millionaires think family offices are out of reach

The Hidden Cost: How traditional wealth models waste time, money, and control

The Micro Family Office: A lean system for managing $1M–$30M with precision

CEO of Your Wealth: How I built a custom strategy for investing, taxes, and legacy

A Better Model: What it looks like to manage wealth like a business—without needing $100M

For those of us who are first-generation high net worth, we want to do this right. We want more control. But the path isn't obvious.

The first steps are the hardest. However, once you start making them, it's hard to turn back.

With that in mind, I want to feed the beast this week. Give you some encouragement by sharing the 7 principles that separate portfolio CEOs from passive investors.

These aren't just concepts—they're the operational framework that transforms how you think about and manage generational wealth.

1. Strategic over reactive. You make systematic decisions based on decision-making frameworks and business plans rather than emotional market responses or random opportunities—you become the architect of your wealth, not its victim.

2. Purpose-driven allocation. Every investment serves a clearly defined WHY and measurable goals. You don't accumulate assets—you engineer specific outcomes.

3. Business-like operations. You treat your portfolio as a scalable enterprise with systems, metrics, teams, and regular review cycles rather than a personal hobby—you operate wealth like the CEO you already are.

4. Institutional thinking, individual implementation. You apply billion-dollar Family Office methodologies but execute them efficiently without the overhead—leveraging technology and fractional expertise to compete with institutional investors.

5. Long-term compounding. You optimize for generational wealth and consistent processes over short-term gains or market timing—you build wealth that outlasts market cycles and personal careers.

6. Measurement discipline. You track performance against documented objectives with the same rigor you'd apply to managing a product or team at work—turning wealth management into a measurable skill.

7. Risk management through frameworks. You diversify and protect wealth through systematic allocation models rather than gut instinct or single-stock concentration—you engineer downside protection while maintaining upside potential.

The Core Transformation

Here's what this really represents: The shift from hoping your money grows to systematically engineering wealth toward specific life objectives—like running any other important business in your life.

You already have the skills. You already understand systems, frameworks, and measurement. You already know how to lead teams and optimize for long-term outcomes.

The only difference? Applying that same rigor to the business of managing your wealth.

The financial industry doesn't want you thinking this way. They profit from your passivity.

But you're not built for passivity. You're built to lead, optimize, and scale.

Your wealth deserves the same strategic attention you give to your product roadmap.

Ready to take the first step? Hit reply and let me know which of these 7 principles resonates most with where you are right now. I read every response.

/ Christopher

P.S. We've got spots opening up for our next intensive. If you're ready to architect your own systematic approach to wealth, let's talk

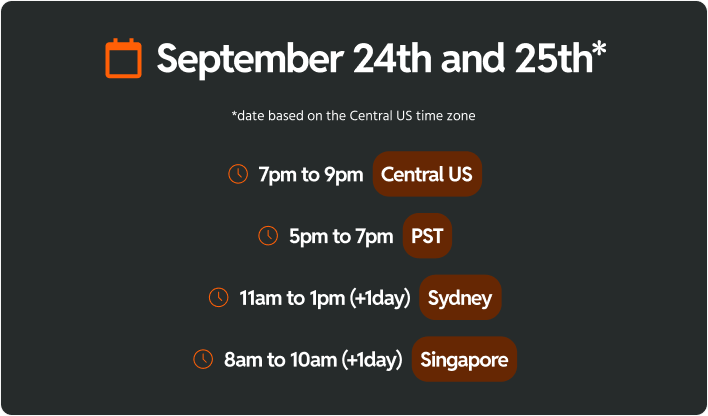

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.