Why I Built My Own Family Office

The moment I realized traditional advice wasn't going to cut it

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

💥 Why a 7-figure IPO left me more anxious than ever

🏛️ The one thing ultra-wealthy families do before they invest a single dollar

🔧 The 7 components that power every functioning family office—and how I built my own

Hey Portfolio CEOs,

I want to tell you the story of how WealthOps started. Not the company—the methodology. The system I built for myself before I ever thought about teaching it to anyone else.

It starts with a moment that looked like success and felt like a ticking time bomb.

In 2012, I found myself standing at a financial crossroads.

I had just gone through an IPO and found myself with a significant windfall. On the surface, it seemed like I was living the dream. But 90% of my wealth was tied up in a single stock, and I had no plan, no strategy—just a growing sense of panic that it could all disappear.

My financial future felt less like an opportunity and more like a ticking time bomb.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m showing you how an 8% return can actually outperform a 12% return—by focusing on what you actually keep, not just the headline numbers.

The Hidden Cost of Taxes: How taxes quietly erode 2–4% of your returns every year

Gross Returns Are Misleading: Why income type matters more than yield

Structured Alpha: The framework that helps ultra-wealthy families measure after-tax performance

Income Architecture + Tax Optimization: How to combine them for dramatically better long-term results

Keep More of What You Earn: How $1M–$30M investors can systematically build wealth without increasing risk

The Fast-Food Advisors

Traditional wealth managers couldn’t help me.

Their advice was painfully predictable: diversify into stocks and bonds, play it safe, and follow the 4% withdrawal rule. I knew that wasn’t going to cut it. I didn’t want a drawdown portfolio where the end goal is to drain it and pray I have some left over.

Why couldn’t I have a portfolio like the ultra-wealthy have?

A portfolio with consistent income—8%, 9%, even 10% cash-on-cash returns—so I could replace my paycheck and build real freedom.

The ultra-wealthy weren’t following that same rulebook, and I wasn’t about to either.

I didn’t want someone to manage my money. I wanted to understand the game I was playing.

That’s when I realized I needed a whole new blueprint.

The Moment It All Clicked

I networked like crazy, studying how family offices actually operate.

The first thing I learned hit me like a lightning bolt: before they invest a dime, they write a legacy statement.

It’s not about money; it’s about purpose. Their “why” becomes their compass—a guide for every decision they make.

At first, it felt fluffy, like something from a motivational workshop. But the more I thought about it, the more I realized how essential it was.

Without a clear purpose, how could I know if I was even building the right portfolio?

One day, while watching my sons play in the backyard, the answer became obvious.

My why wasn’t complicated. It was right in front of me the whole time:

I wanted financial independence so I could walk with my sons on their journey from boys to men. I wanted to be fully present for the moments that mattered. And once they left home, my wife and I would live life on our terms—travel, experience, and work on meaningful impact projects.

That realization changed everything.

Suddenly, this wasn’t about spreadsheets or market trends. It was about designing a life that aligned with what mattered most.

I had my why. Now, I needed a plan.

Turning Purpose into Strategy

A legacy statement is the foundation, but an investment thesis is the roadmap.

Once I had clarity, I started setting real goals: how much income I needed, how much risk I could handle, and what combination of assets would get me there.

I quickly realized I couldn’t just guess. I needed to architect my portfolio—carefully and intentionally.

I spent the next several years studying Single Family Offices. Not just the investment strategies—those are documented everywhere. The infrastructure. The operating model. What actually makes these structures function for 50, 100, 150+ years?

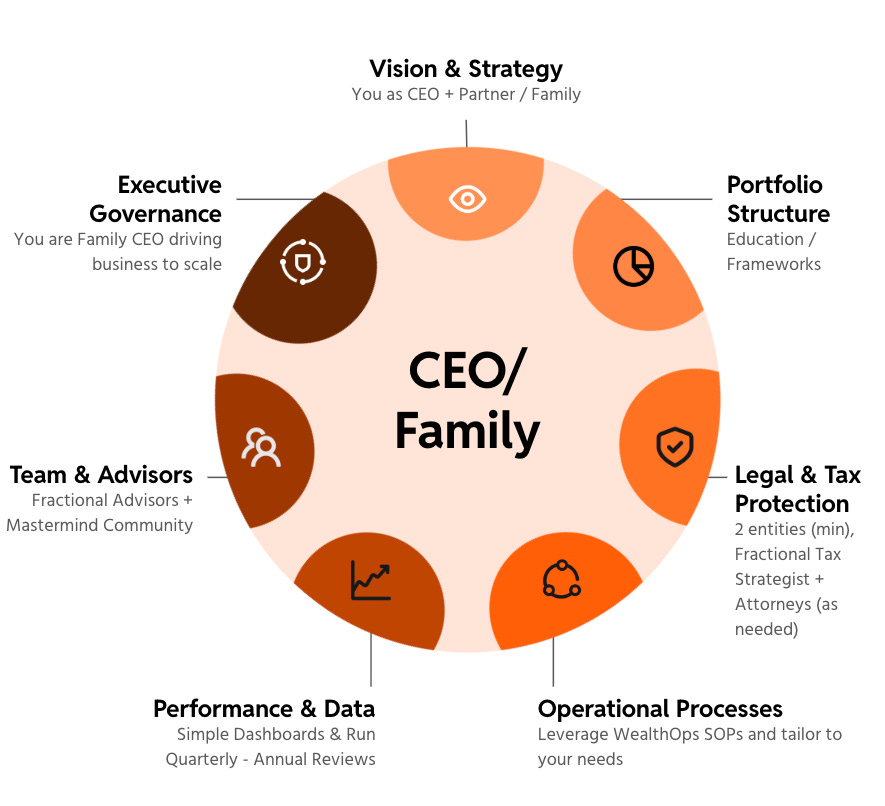

Here’s what I found: every functioning family office runs on the same 7 core components.

Vision. Structure. Protection. Process. Data. Advisory Partners. Governance.

The complexity varies wildly. A $500M office might have 20 people executing these functions. A $50M office might have 3. But the components are identical.

And when I looked at those components through the lens of business operations—a world I knew—I realized something:

Most of this is operational work I already know how to do.

Project management. Vendor coordination. Process documentation. System design. Data analysis. Strategic planning. The domain was new. The discipline wasn’t.

Building My Own Family Office

So I built one. Piece by piece:

Vision — I wrote that legacy statement with my wife. What do we actually want this money to do? What matters beyond the numbers?

Structure — I designed an

Protection — I assembled a legal framework. Asset protection trusts. Insurance analysis. Tax defense strategies with entity architecture. A Holding Company to protect assets. A Management Company to generate income. A clear system instead of accounts scattered everywhere.

Process — I documented the recurring work. Quarterly reviews. Annual planning. How decisions get made. What happens when.

Data — I built tracking systems. Real-time visibility into everything. One source of truth instead of logging into 12 different portals.

Advisory Partners — I assembled a team. Not one generalist advisor, but specialists: a Certified Tax Planner, a trusts attorney, a CPA who understood my situation. I coordinate them. They execute.

Governance — I created decision frameworks. The 30-Second Decision Filter for investment opportunities. Family meetings. Documented policies.

The Shift

For the first time in years, I felt free.

I wasn’t living in fear of losing everything. I knew exactly what I was building and why. The chaos turned into control, and I had a clear direction.

Every decision became easier. Every step took me closer to the life I was designing.

It wasn’t always easy, but it was simple. Once the architecture was in place, the pieces started falling together.

The identity shift was profound: I went from feeling like a client who needed experts to rescue me, to feeling like a CEO running a business I understood.

I still use advisors. But they execute within my strategy. They’re specialists on my team, not authorities I defer to blindly.

That’s a completely different relationship with your wealth.

From System to Methodology

Once the system was working for me, friends started asking questions.

“How did you set up your entities?”

“Who do you use for tax planning?”

“How do you evaluate private investments?”

At first, I just shared what I’d built. Spreadsheets. Documents. Frameworks.

But I realized: what they actually needed wasn’t my specific system. It was the methodology for building their own.

Their numbers were different. Their goals were different. Their situations were different. But the components were the same.

Same principles. Scaled execution.

That realization became WealthOps.

Key Takeaways

Start with your why. Without a clear purpose, you’re building a portfolio that may not align with what actually matters to you.

Family offices run on 7 components. Vision, Structure, Protection, Process, Data, Advisory Partners, Governance. The complexity scales—the components stay the same.

Your operational skills transfer. Wealth management is system management. If you can run operations, you can run a portfolio.

Your Reflection This Week

Here’s what I want you to think about:

What’s your why?

Not a number. Not “more money.” What does financial independence actually mean for your life?

If you had the portfolio generating the income you needed, what would you do with the freedom? Who would you spend time with? What would you build?

Start there. Everything else will follow.

That’s the shift from money maker to Portfolio CEO.

And if I can build this, so can you.

Let’s keep building.

—Christopher

P.S. This newsletter kicks off a new year of Managing Tech Millions. Every week, I'll share the frameworks, systems, and lessons that have shaped how I think about building and running a Micro Family Office. If you're new here—welcome. If you've been reading for a while—thank you for being part of this.

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.