Why most people won't follow through (and how to be different)

How to set yourself up to actually build your Micro Family Office in 2026

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

🎯 Why most wealth-building goals fail before February (and how to avoid it)

📅 The calendar strategy that separates intention from execution

📋 The three things you need in place to make your MFO real in 2026

Hey Portfolio CEOs,

Last week, I shared my entire Annual Portfolio CEO Review.

The moves I’m making with my $8M portfolio. The operations I’m simplifying. The succession planning I’m building with my sons.

I got a lot of replies. People resonating with the framework. People saying “this is exactly what I need to do.”

But here’s what I know about January:

Intention is cheap. Execution is everything.

Right now, you’re energized. New year. Fresh start. Big plans.

By February? Most people are back to the grind.

The portfolio review they meant to do is still sitting on their to-do list. The Investment Thesis they planned to write never got started. Life took over.

I don’t want that to be you.

So today, I want to talk about something that doesn’t get enough attention: how to actually set yourself up to succeed.

Not the strategy. Not the frameworks. The execution infrastructure that makes sure this actually happens.

This week, I’m showing you how I structured my $6M portfolio to generate income and grow—so I could retire early without worrying about market volatility.

The Real Wealth Trap: Why traditional retirement advice doesn’t work for high earners

Evergreen Portfolio Explained: A balanced approach to growth, safety, and income

Cash Flow without Selling: How I avoided liquidating assets by building income-generating investments

Retire Early with Confidence: How I created a system that funds my lifestyle while growing my wealth

The Ultra-Wealthy Model: How the top 1% manage money and what you can learn from it

Why This Is Hard

Let’s be honest about what you’re up against.

You’re busy. You have a demanding career, a family, and a hundred things competing for your attention.

Your portfolio? It’s not on fire. Nothing is forcing you to deal with it today. So it gets pushed to “someday.”

And someday never comes.

This is why most tech professionals have millions in assets but no system. Not because they don’t know what to do—but because they never create the conditions to actually do it.

Building a Micro Family Office requires treating it like what it is: a business.

And businesses don’t run on good intentions. They run on clarity, commitment, and structure.

Here are the three things I’ve found that separate people who talk about building their MFO from people who actually do it.

1. Give Your Wealth a Mission

This is where everything starts.

If your wealth is just a number—a pile of assets sitting in various accounts—it will never feel urgent enough to prioritize.

But when you give your wealth a purpose? When it becomes more than money? Everything changes.

This is why the Legacy Statement is so important.

A Legacy Statement is your wealth’s mission statement. It answers the question: What is this money actually for?

Not “retirement.” Not “security.” Something more specific. Something that matters to you.

Maybe it’s: “Our wealth exists to create educational opportunities for three generations while giving our family the freedom to pursue meaningful work.”

Maybe it’s: “Our wealth exists to generate $200K in annual income so we never depend on an employer again, while funding clean water access in developing countries.”

When you have a mission, your Micro Family Office stops being a “nice to have” and becomes a business you’re building.

You don’t skip working on a business you care about. You don’t let it drift to “someday.”

If you haven’t written your Legacy Statement yet, that’s the first thing to do. Sit down this week—even if it’s just 30 minutes—and draft the first version. It doesn’t have to be perfect. It has to exist.

Purpose creates pull. And pull beats discipline every time.

2. Block Your Calendar Like It’s Sacred

Here’s the uncomfortable truth:

If it’s not on your calendar, it doesn’t exist.

You block time for meetings. You block time for workouts (hopefully). You block time for your kids’ events.

When’s the last time you blocked time for your wealth?

Most people treat their finances like something they’ll “get to” when they have a spare moment. But spare moments don’t happen to people with demanding careers and full lives.

You have to manufacture the time. Deliberately. In advance.

Here’s what I recommend:

Block a recurring monthly “MiFO CEO Session.”

Put it on your calendar right now. 2-3 hours, once a month. Non-negotiable.

This is your time to:

Review your portfolio allocation

Check on investment performance

Handle administrative tasks

Work on your Investment Thesis or business plan

Think strategically about what’s next

Protect this time like you’d protect a board meeting.

Because that’s what it is. You’re the CEO of your family’s wealth. This is your board meeting with yourself.

Some people do it the first Saturday of every month. Some do a Friday afternoon. Find what works for you—but get it on the calendar now, for the entire year.

The calendar doesn’t lie. What you schedule is what you value.

3. Have a Concrete Business Plan

Vague goals produce vague results.

“I want to get my finances in order” is not a plan. “I should diversify” is not a plan. “I’ll figure it out this year” is definitely not a plan.

A Micro Family Office needs a business plan just like any other business.

What are you actually trying to accomplish in 2026? What are the specific moves? What’s the timeline?

Last week, I shared my plan:

Portfolio: Close underperformers, double down on proven operators, increase public market exposure

Operations: Consolidate to Interactive Brokers, audit all tools and subscriptions

Succession: Kids selecting family charity, oldest son learning options portfolio, ramping up family board meetings

That’s concrete. That’s measurable. I can look back in December 2026 and know if I did it or not.

Your plan doesn’t have to look like mine. But it has to exist.

If you haven’t created yours yet, go back to last week’s newsletter and use the three questions as your starting point:

Portfolio — Where will you divest and invest?

Operations — What will you simplify?

Succession — How will you future-proof your portfolio?

Write down your answers. Make them specific. Give them deadlines.

A written plan is a commitment. An unwritten plan is a wish.

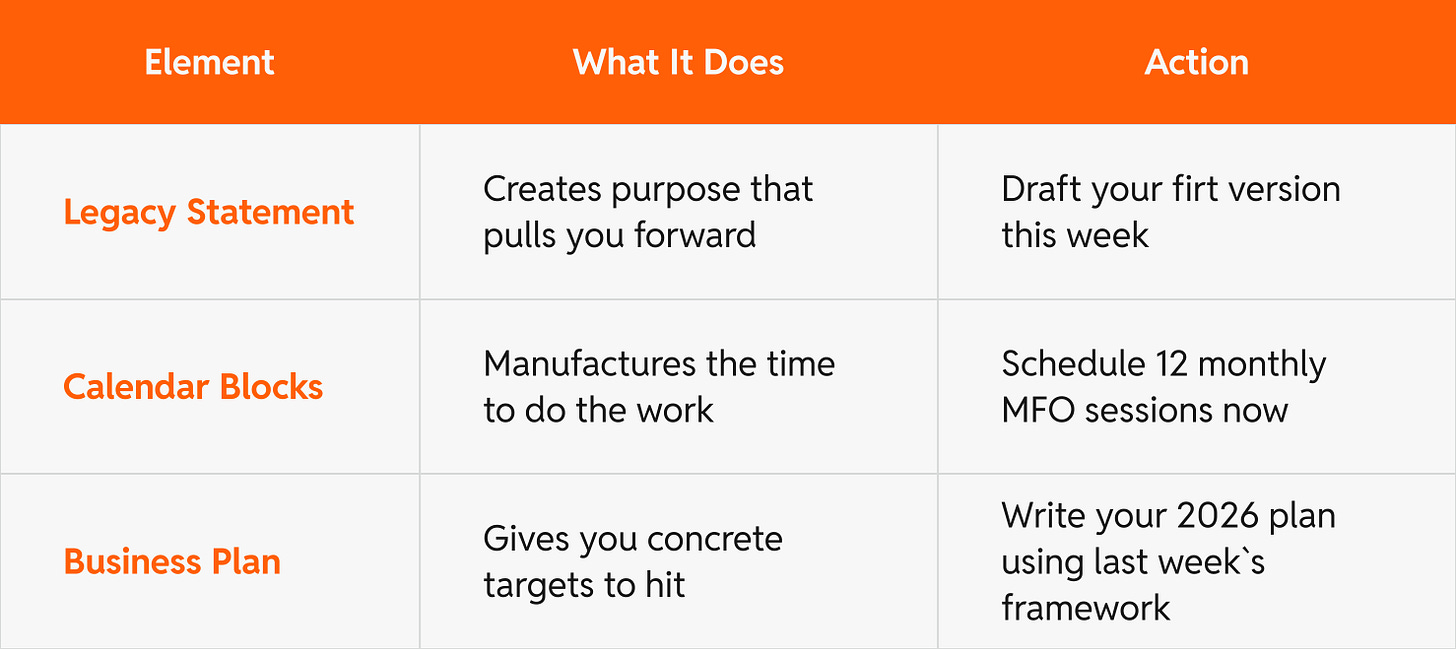

The Execution Stack

Let me put this together for you.

If you want to actually build your Micro Family Office in 2026—not just think about it—you need three things in place:

Purpose. Time. Plan.

Without purpose, you won’t prioritize it.

Without time, you won’t do it.

Without a plan, you won’t know what to do.

Get all three in place this month, and you’ve already separated yourself from 90% of people who said they’d “get their finances together” this year.

This Is the Work

I’m not going to sugarcoat this.

Building a Micro Family Office takes effort. It’s real work. It requires you to carve out time from an already full life and dedicate it to something that doesn’t feel urgent—until it suddenly does.

But here’s what I can tell you from the other side:

It’s worth it.

The clarity. The confidence. The knowledge that your wealth is actually working for you—not just sitting there. The peace of knowing your family could take over if something happened to you.

That doesn’t come from good intentions. It comes from execution.

So here’s my challenge for you this week:

Write your Legacy Statement (or revisit the one you have)

Block your 12 monthly MFO sessions on the calendar

Write your 2026 business plan using the three questions

Do those three things, and you’re not just thinking about your Micro Family Office anymore.

You’re building it.

Here’s to execution in 2026.

Best / Christopher

Need Help Getting Started?

If you want a structured framework to build your Investment Thesis, design your portfolio architecture, and create your MFO business plan, that’s exactly what we cover in The WealthOps Way workshop.

The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In one session, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.