Your Portfolio's Insurance Policy (That Most Tech Professionals Forget to Buy)

Most days you won't notice it. But when markets turn, you'll thank yourself.

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

🛡️ Why stock concentration is the hidden risk most tech professionals ignore

📊 How systematic diversification protects your portfolio and reduces emotional stress

⚙️ How to turn your equity into an income-producing, resilient portfolio through discipline

Hey Portfolio CEOs,

Many tech employees have a similar problem that no one talks about.

Stock concentration.

It’s our dirty little secret that comes from a combination of getting stock as part of compensation, companies doing well, and not making time to fix it. It’s also easy to get caught up in the “I don’t want to pay the tax bill” game.

The reality is this kind of thinking can do more harm than good and quickly rob the value of something we worked so hard to build.

Today, I want to introduce you to your portfolio’s insurance policy: diversification.

I also want to expose how the C-Suite is managing this so you can learn from them and not just build but grow and scale your wealth.

Let’s dig in.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m sharing exactly how I turned a $530K portfolio into $200K+ of annual income—and what I’d do differently if I were starting over today.

The Two Paths: Why I chose income over passive growth—and never looked back

From $57K to $200K: How my first 9 investments became a cash-flow machine

What I’d Change: The updated strategy I’d follow with $500K today

The 5-Part Framework: A simple plan to build income without becoming a full-time investor

Boring by Design: How a scalable, low-stress system became my greatest financial asset

The Problem Nobody Talks About

I’ll never forget the call I got in early 2022.

A former colleague—let’s call him Marcus—had just watched his net worth drop by $1.5 million in three months.

His company’s stock, which made up 85% of his portfolio, had cratered after a rough earnings call. “I knew I should have diversified earlier,” he told me. “But the stock kept going up. It felt like I was winning.”

Marcus isn’t alone. I’ve watched this same scenario play out dozens of times with tech professionals who built impressive wealth through equity compensation, only to see it evaporate because they treated concentration like a strategy instead of the risk it actually is.

Think of diversification like your portfolio’s insurance policy. Most days? You won’t notice it. But when markets turn—and they will turn—you’ll be thanking your past self for having the discipline to spread your risk.

Here’s what nobody tells you: Your CEO already has this insurance policy. And it’s time you learned what they know.

What Your C-Suite Is Doing (That You’re Not)

While you’re agonizing over whether to sell “just a little” of your company stock, your executives have already set up systematic, automated diversification plans.

They’re called 10b5-1 plans, and they’re the secret weapon the ultra-wealthy use to diversify concentrated holdings without emotion, timing risk, or compliance headaches.

Here’s what a 10b5-1 plan actually is:

It’s a pre-written contract between you and your broker that specifies exactly when, how much, and at what conditions you’ll sell shares. Once you set it up, trades happen automatically—no decisions, no second-guessing, no panic selling.

Think of it like setting up automatic bill pay, except instead of paying your mortgage, you’re systematically de-risking your portfolio.

Why executives use them:

Executives accumulate massive equity positions through RSUs, stock options, and ESPP shares. Their net worth becomes dangerously tied to one ticker. A 10b5-1 plan lets them:

Diversify concentrated holdings by spreading sales over time, reducing single-stock exposure

Automate selling discipline, removing emotion and timing bias from the equation

Maintain regulatory compliance, since sales are pre-scheduled and publicly disclosed

Access liquidity strategically while managing tax events from option exercises or large vestings

How they actually work:

Plans include specific parameters you define upfront:

Number of shares to sell (or a formula-based approach)

Dates or price triggers that execute the sales

Duration (typically six months to two years)

Cooling-off periods before the first trade executes

Your CFO isn’t trying to time the market. She’s systematically selling 10,000 shares every quarter, regardless of whether the stock is at $150 or $180. Over time, she averages out her exit price and eliminates the emotional weight of “did I sell at the right time?”

That’s the playbook the wealthy use to build and grow generational wealth.

The Strategy You Should Implement (Starting This Week)

Here’s where this gets tactical for you.

Step 1: Ask if you’re eligible

Many companies offer 10b5-1 plans to employees beyond just the C-Suite. You need to advocate for yourself and ask:

Does our company allow employees at my level to establish 10b5-1 plans?

What are the requirements and compliance procedures?

Who internally can help me set one up?

Don’t assume you’re not eligible. Ask the question. Push for access. This is how you start operating like the wealthy—by demanding access to the same tools they use.

Step 2: If you’re not eligible, set up your own systematic plan

Even without a formal 10b5-1 plan, you can create your own systematic diversification schedule. Here’s how:

Define your concentration threshold. For most tech professionals, keeping more than 20-30% of your net worth in a single position is excessive risk. Write down your target allocation before emotions get involved.

Create a dollar-cost-averaging exit schedule. Instead of trying to time the perfect sale, commit to selling 5-10% of your position quarterly. Set calendar reminders. Treat it like a business process, not an emotional decision.

Reinvest with intention. The money you divest shouldn’t sit in cash waiting for you to “figure it out later.” Have a clear investment thesis—diversified public equities, private equity income investments, real estate. Transform concentrated risk into distributed income-producing assets.

Navigate tax implications proactively. Work with your tax advisor to understand optimal timing. Sometimes paying the tax hit is worth the risk reduction. Don’t let tax considerations become an excuse for inaction.

Step 3: Commit to self-reliance

The uncomfortable truth: your company benefits from you staying concentrated. Your wealth tied to their stock keeps you motivated, loyal, and financially dependent on their success.

But your financial independence requires you to think differently.

The C-Suite diversifies because they understand that wealth preservation requires systematic risk management. They don’t wait for permission. They don’t wait for the “perfect time.” They architect systems that execute regardless of market conditions or emotional state.

You need to do the same.

The Fire Insurance Problem

Most tech professionals wait until their single stock position tanks before they diversify. That’s like buying fire insurance while your house is already burning.

When you’re forced to diversify during a downturn, everything works against you:

Your stock is depressed, so you’re selling at the worst price

Your options are limited—the market has leverage, not you

Emotional weight makes execution harder

You’re making reactive choices instead of strategic ones

Compare that to diversifying from a position of strength: your stock is healthy, you have time to be strategic about tax implications, you can systematically exit over time, and most importantly, you’re making the decision on your terms.

This is the leverage point most people miss.

The best time to diversify is when you don’t feel like you need to. When the stock is performing well. When the tax implications sting a little. When it feels counterintuitive.

That’s the insurance premium you’re paying today for portfolio resilience tomorrow.

What Experience Actually Teaches You

During my years as a tech executive, I watched the same pattern repeat: people would hit a liquidity event, ride the high of a climbing stock price, then panic when reality hit.

I did it myself early on. After my first IPO, I held onto my shares far longer than I should have because I couldn’t separate my identity from the company’s success. When the stock eventually corrected, I learned an expensive lesson about the difference between loyalty and strategy.

Here’s what experience teaches you: diversification isn’t about being pessimistic about your company. It’s about being realistic about risk and systematic about wealth management.

The executives selling shares through 10b5-1 plans aren’t bearish on the company. They’re bullish on their own financial independence. They’re executing the same strategy that every sophisticated investor uses: systematic rebalancing based on predetermined thresholds, not emotional reactions to market movements.

That’s how wealth is built and grown over decades, not gambled on quarterly earnings calls.

Your Insurance Premium Is Due

The uncomfortable truth: you’re paying an insurance premium one way or another.

Either you pay it proactively by diversifying when you have leverage, or you pay it reactively when the market forces your hand—and that premium is always more expensive.

Your CEO understands this. Your CFO understands this. The ultra-wealthy understand this.

Now you understand it too.

Navigate this proactively. Diversify when you have the leverage to do it on your terms, not when panic forces your hand. Your future self will appreciate the insurance premium you paid today.

What’s your experience with diversification? Have you asked about 10b5-1 plan eligibility? Have you set up your own systematic exit strategy? Reply and share your story—I read every response.

Ready to take action? Here’s your next step this week:

Block 30 minutes to calculate your current concentration risk. What percentage of your net worth is in company stock?

Send one email to your HR or legal team asking about 10b5-1 plan eligibility at your level

If you’re not eligible, set up a systematic quarterly selling schedule in your calendar for the next 12 months

Don’t wait for the market to force your hand. Build the system now while you have leverage.

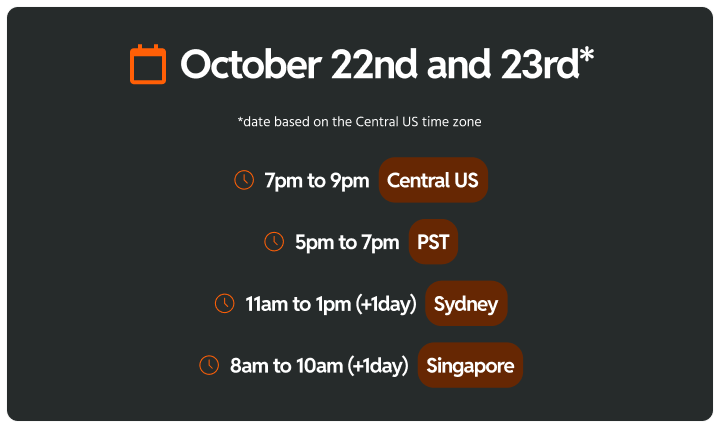

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.