THIS is Why Managing Millions Feels Impossible

New data reveals 95% of financial education ignores what actually works

👋 Managing Tech Millions 📈 your go-to source for building wealth with tech equity and managing the money that comes with it.

Every Thursday, we'll deliver a concise and powerful lesson on building wealth working for equity compensation or on managing your seven and eight-figure portfolio.

Today, in 5 minutes or less, you’ll learn:

🚀 How to stop treating your wealth like a hobby and run it like a system

📈 Why private assets, tax strategy, and operational rigor outperform public markets

🛠️ The three defense mechanisms that keep you from real wealth management

Hey Portfolio CEOs,

As I was meeting with a WealthOps coaching client this week, they asked me a question that I know plagues many people who’ve come into new wealth:

“Why is it so hard to find out how to manage wealth like the ultra-wealthy? It feels like I’m trying to debug code without documentation.”

I had to share with them what I discovered many years earlier:

It’s not you. The system was literally designed to keep these strategies hidden.

Here’s the kicker – the majority of financial education provided while you’re working corporate jobs? It’s delivered by companies selling you specific products.

Their messaging about risk, complexity, and what they would or wouldn’t do has implicit bias baked right in.

Like many of you, I discovered this the hard way.

So what can you do about it?

To defeat an opponent, you need to first understand them.

Managing Tech Millions is a Weekly Podcast that gives you deep dive conversations into building and growing wealth with myself and other industry experts.

This week, I’m breaking down how high earners sabotage their own wealth by holding on to a middle-class money mindset.

Outdated Thinking: Why “buy and hold” and 60/40 portfolios don’t work at eight figures

Small-Money Strategies, Big-Money Problems: The hidden cost of applying the wrong playbook

From Accumulation to Operation: How I shifted from growing wealth to making it work

Think Like the Wealthy: Asset allocation, tax reduction, and income generation that actually scales

Build Intentionally: Because wealth needs structure—not just growth—to last for generations

2012: The Day I Discovered I Was Getting Played

After my IPO, I became a multi-millionaire overnight. I’d read Kiyosaki’s Rich Dad Poor Dad. I was ready for Quadrant 4 – where investments pay YOU.

Morgan Stanley sent their “best” advisor to our newly-public company – one of the hottest IPOs of 2012. After an hour of his pitch, I sat there stunned.

This was it?

The same 60/40 portfolio and 4% drawdown strategy they feed everyone else?

I knew something was wrong. So I fired the “fast food” financial advisors and started doing the work myself.

That’s when things got REALLY hard.

There was no real information anywhere on how the ultra-wealthy actually build and manage wealth. Every search led to the same basic advice. Every “advanced” course taught the same public market strategies.

I had to know: Why is it so damn hard to find out how the ultra-wealthy really manage money?

After 12 years of digging, here’s what I discovered...

The Data Bomb: The Financial Education System is Rigged Against You

Let me hit you with some numbers that’ll make your head spin:

95% of financial education covers budgeting, saving, and basic investing

Less than 5% teach strategies the wealthy actually use

Family offices allocate 30-60% to private assets

Your portfolio probably: 90% public stocks, 10% wondering why you’re not getting ahead

Think about that. You’re learning from a playbook that ignores 95% of wealth-building strategies.

It’s like trying to build a distributed system using only HTML.

Sure, you can make a webpage, but you’re missing 95% of the tools you need for real scale.

Here’s what every family office knows (but your advisor won’t tell you):

🚫 How family offices turn one fortune into generational wealth

Not through index funds, but through building their wealth as a business and bringing their kids and family into the business. They bring in interns to scale like a start-up.

🚫 Why the ultra-wealthy run portfolios like tech companies

Architect → Build → Run cycles (sound familiar?) Weekly sprints, quarterly reviews, annual pivots. They’re running wealth like you run products.

🚫 The real reason private equity crushes public markets

18.8% vs 9.9% returns over 5 years. It’s not luck – it’s direct control, tax advantages, and actual influence over outcomes.

🚫 Why Tax Strategists beat CPAs every time

CPAs record history. Tax strategists design the future. The wealthy pay for strategy, not compliance.

The System’s Three Defense Mechanisms

So why can’t you just Google this stuff? Three walls stand between you and real wealth management:

1. The Accreditation Gate

“Sorry, these investments are too dangerous for you.” Translation: We’re keeping the best returns for ourselves.

2. The Advisor Industrial Complex

Trained on the same 60/40 model since 1952. They make money whether you grow wealth or not. It’s SaaS for them – recurring revenue regardless of your outcomes.

3. The Complexity Myth

“These strategies are too sophisticated for you.” Reality: You manage distributed systems with millions of dependencies. You can handle an advanced portfolio structure.

Your Bridge to the Other Side

After 12 years of reverse-engineering how Single Family Offices actually work, I realized something:

We’re running our wealth like hobby projects when we should be running them like production systems.

You wouldn’t deploy code without CI/CD.

Why are you deploying millions without an operating system?

Your 3-Step Escape Plan

This week’s mission (choose your difficulty level):

🟢 Easy Mode:

[Read the Micro Family Office Guide] – understand the alternative to “financial advisors”

🟡 Medium Mode:

[Review The 5 Problems a Micro Family Office Solves] and identify which ones are costing you the most

🔴 Hard Mode:

Write your Legacy Statement. Answer: “What do I want my wealth to do for me?”

In 2017, sitting on millions and burning out in corporate, I wrote mine:

“I want financial independence so I can spend more time with my family.”

Five years later, I left corporate forever. That statement changed everything.

Stay Intentional / Christopher

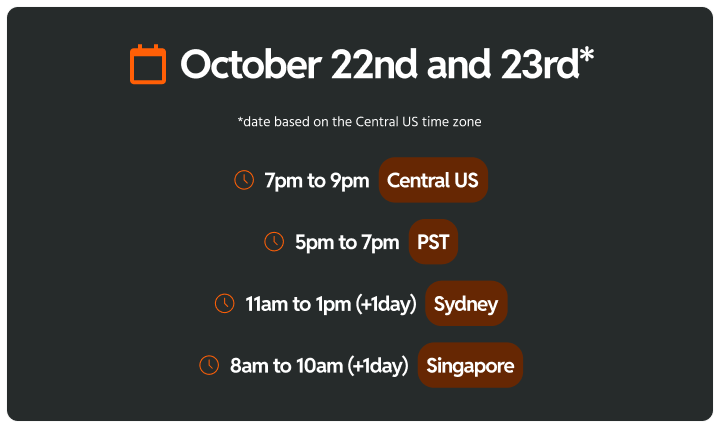

Join me for The WealthOps Way—our free live masterclass designed to help you stop guessing and start running your wealth like a business.

You’ll go from scattered to strategic as you craft your own Portfolio Thesis—the foundation of everything that follows.

👉 In just two sessions, you’ll:

Clarify your long-term vision

Define your next best investment move

Build the system that turns wealth into freedom

Spots are limited—and the clarity you’ll gain? Game-changing.

Let’s build your portfolio like it’s your next great company!

If you like the newsletter, support us by letting us know what you think (one click); please do that now!

PS...If you're enjoying Managing Tech Millions, please consider referring this edition to a friend.

And whenever you are ready, there three ways I can help you:

Follow me on LinkedIn: Get more insights and real-time updates.

Tune into the Podcast: Dive deeper into wealth strategies and interviews.

Get in Touch: Ready for a bigger move? Let’s talk.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial or career advice. Always consult with qualified professionals before making any decisions based on the information provided.